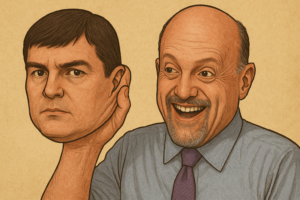

Cramer Just Predicted a Market Rally. We’re Screwed.

Latest news

-

Max Profit - July 11, 2025

-

Ima Short - July 9, 2025

Elon’s AI ‘Grok’ Goes Full Nazi To The Suprise Of No One

-

Max Profit - July 8, 2025

Jack Dorsey Unveils ‘Bitchat’, Musk Already In Talks To Buy And Rename It ‘XChat’

-

Pen Smith - July 7, 2025

Elon Starts America Party, Trump Forms South Africa Party In Retaliation

Jim Cramer, the renowned CNBC personality known for his bold Wall Street and finance segments, might have just sealed our financial doom. Cramer, who has become a bit of a financial Cassandra (only in reverse), is infamous for his often misguided market predictions, leading to what many traders wryly refer to as the “inverse Cramer effect.” This curious phenomenon suggests a simple yet bizarre strategy: do the exact opposite of what Cramer recommends.

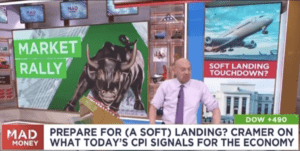

This week, following the release of the Consumer Price Index (CPI) data that hinted at a decrease in inflation, Cramer took to his show with his usual flair. He made a bold prediction about Federal Reserve Chairman Jerome Powell orchestrating a “soft landing” for the economy and spurred talks of an imminent market rally. Under normal circumstances, this would be cause for celebration. However, in the bizarro world of Cramer’s financial forecasting, this is the equivalent of sounding the alarm bells.

Why, you ask? Because Cramer’s track record reads like a how-to guide on being spectacularly wrong. His latest prophecy has left seasoned investors and market watchers in a state of high alert. The fear is palpable – if Cramer says up, history suggests the market is about to take a nosedive down.

So, what does this mean for the average Joe and Jane with their 401(k)s and modest portfolios? In the words of financial analysts who have learned to read the tea leaves of Cramer’s forecasts: brace yourselves. We might be on the cusp of not just a hard landing but a full-blown, buckle-your-seatbelts, hold-onto-your-hats, prolonged bear market, and potentially a recession that could make the 2008 financial crisis look like a hiccup.

In light of this, the new market mantra might just be “Cramer says buy; we say bye!” As unconventional as it sounds, in a world where up is down and left is right in the realm of financial predictions, doing the opposite of what Jim Cramer suggests could be the safest bet for your financial health. So, when Cramer says it’s time to rally, perhaps it’s really time to batten down the hatches and prepare for a financial storm.

Remember, in the topsy-turvy world of Wall Street, sometimes the best advice comes from the least expected places – like doing the exact opposite of what a famed finance guru suggests. So, as Cramer’s latest prediction of economic sunshine and rainbows makes the rounds, savvy investors might just be quietly whispering to themselves, “Sell everything.” Because, in the end, the inverse Cramer effect might be the most reliable financial advisor we’ve got.

Not financial advice.

Latest news

-

Max Profit - July 11, 2025

Kellogg Stocks Soar 5% Ahead Of Ferrero Takeover, Nutella Cornflakes Announced

-

Ima Short - July 9, 2025

Elon’s AI ‘Grok’ Goes Full Nazi To The Suprise Of No One

-

Max Profit - July 8, 2025

Jack Dorsey Unveils ‘Bitchat’, Musk Already In Talks To Buy And Rename It ‘XChat’

-

Pen Smith - July 7, 2025

Elon Starts America Party, Trump Forms South Africa Party In Retaliation