Pyramid Scheme of the Week!

Latest news

-

Ima Short - February 17, 2026

-

Pen Smith - February 16, 2026

Grok Just Recommended Putting Vegetables Up Your Ass As Official Government Nutrition Advice

-

Ima Short - February 12, 2026

Netflix Stock Is Down 15%, Should You Buy The Dip?

Yes, it’s that time of the week! Welcome back to the inaugural ‘Pyramid Scheme of the Week’ feature! In which we award one budding Pyramid Scheme the grand prize of our $2,000 dollar investment.

This week’s winner is… drumroll…

Banks!

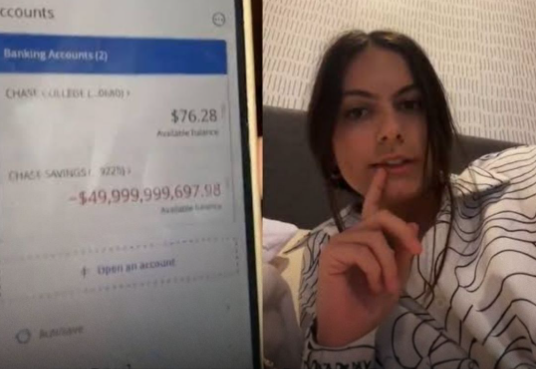

Yes, you read that right. Banks. From your regular old brick-and-mortar bank to your online-only Quizo E-Wallet, you’re putting money in, not getting much out, and somehow they just keep getting richer and richer?? With all the money getting funnelled to the top? What’s that about?

Let me draw you a diagram of what that looks like… oh, yeah, it’s a pyramid.

Anyway, that’s all for this week! Tune in next week to see if your small business makes the list.

For another story just like this, click here: This Week’s Top 6 Ponzi Schemes To Invest In

Speaking of pyramid schemes, if you’d like to read what an AI generated based off this prompt you sick fuck, read on:

In a market saturated with get-rich-quick opportunities ranging from JPEG-based monkeys to cryptocurrencies named after dog breeds, one company is disrupting the disruptive space by offering a refreshingly honest approach to financial ruin: a literal pyramid scheme. The Inverted Funnel Group, a startup celebrated for its “Pyramid-to-Table” business model, has just been crowned this publication’s “Pyramid Scheme of the Week” for its unprecedented transparency and its commitment to ensuring only the person at the very top makes any money.

“Look, we’re not here to sell you on vague promises of ‘synergy’ or ‘quantum-entangled wellness elixirs,’” said founder and Chief Visionary Apex, Blaze Kensington, speaking to reporters from a gold-plated hoverboard in his mother’s garage. “Our product is the pyramid. You buy into the pyramid. You sell the pyramid to others. It’s a structure so mathematically sound it was rejected by every architect in ancient Egypt for being ‘too top-heavy.’”

The Inverted Funnel Group’s flagship offering is the “Geometrically-Enhanced Opportunity Packet” (GEOP), which for a modest entry fee of $2,500 contains a glossy brochure detailing the company’s compensation plan, a certificate of participation printed on what appears to be resumé paper, and a single, encouraging sentence: “Now, find more people.”

This straightforwardness has resonated powerfully with a generation of investors burned by the complexities of options trading and the unpredictability of the stock market.

“I lost my 401k YOLOing into weekly puts on a company that makes sustainable alpaca socks,” said Kevin Mandelbaum, 34, a former accountant who was recently promoted to the rank of “Sand-Shifter” within the organization. “With The Inverted Funnel Group, the risk is clear. The company prospectus literally has a diagram with my face at the bottom and a giant, laughing sun with Blaze Kensington’s face at the top. It’s the kind of clarity you just don’t get from the Federal Reserve.”

Mandelbaum, who operates from a command center he calls his “downline nexus” (a stained corner of his couch), spends his days leveraging what he calls “human capital derivatives”— badgering his extended family on Facebook and ambushing old high school acquaintances in the supermarket.

“The beauty is in the simplicity,” he explained, gesturing to a whiteboard covered in a complex web of names, arrows, and sad faces. “My job is to recruit five people. Their job is to recruit five people each. Once we have recruited every single person on Earth, including a few isolated tribes in the Amazon, we all get our ‘tendies.’ It’s basic math.”

Experts are cautiously impressed by the company’s brazenness. Dr. Penelope Frank, a leading researcher at the Institute for Obvious Financial Structures, noted that The Inverted Funnel Group represents a paradigm shift.

“For decades, multi-level marketing companies have gone to great lengths to hide their pyramidal nature, using products like essential oils, leggings, or nutraceuticals as a fig leaf,” Dr. Frank stated. “Kensington has simply removed the fig leaf. It’s bold. It’s audacious. And our models indicate a 100% probability of collapse. It’s the most predictable thing in finance since a 22-year-old on Robinhood discovers 100x leverage.”

The company’s internal hierarchy is, fittingly, pyramid-themed. New recruits start as “Sand-Shifters.” With five recruits, they become “Brick-Layers.” At twenty-five, they achieve the coveted rank of “Pharaoh’s Architect,” which comes with a company-leased 2014 Honda Civic painted “Lambo-beige” and the right to host mandatory, unpaid “mindset webinars” on weekends.

Tiffany “T-Money” LaSalle, a 28-year-old “boss babe” and Pharaoh’s Architect, touts the lifestyle. “I am my own CEO,” she said, adjusting the ring light in her childhood bedroom. “I work my own hours, which are 24/7, and I’m building an empire. My downline is a diversified portfolio of my sorority sisters, my mom’s book club, and three guys I matched with on Hinge who thought this was a date.”

When asked about her earnings, LaSalle became evasive, mentioning that “true wealth isn’t measured in dollars, but in the freedom to alienate your entire social circle for a shot at greatness.” Records indicate her net income last month was -$47.50 after accounting for brochure printing costs.

Founder Blaze Kensington remains unphased by criticism. He sees himself as a populist hero, freeing the masses from the tyranny of traditional employment.

“The 9-to-5 is the original pyramid scheme,” he preached, his voice echoing slightly in the garage. “You have a CEO at the top, VPs below him, then middle managers, then the wage-slaves at the bottom. The only difference is they make you do ‘work.’ We’ve streamlined the process to focus on the most essential corporate task: recruitment. We cut out the fat, like healthcare, product development, and salaries.”

The appeal to the wallstmemes crowd is undeniable. For a community that prides itself on diamond-handing stocks to zero and treating financial advice from anonymous Reddit users as gospel, The Inverted Funnel Group is the ultimate degenerate play.

“It’s like buying a meme stock, but instead of short-sellers, your enemy is your Aunt Carol’s skepticism,” commented one user on a popular forum. “The DD is solid: someone is definitely going to get rich. It’s probably not me, but the possibility is intoxicating.”

Looking to the future, Kensington has big plans. He’s currently in talks to launch FunnelCoin, a proprietary cryptocurrency whose value is pegged to the number of new recruits. He also envisions an IPO under the ticker symbol PYMD.

“We’re projecting that, by Q4 2025, The Inverted Funnel Group will have a larger base than the population of North America,” Kensington declared, eyes gleaming with the fervor of a man who truly believes his own nonsense. “The only thing trickling down in this economy is the tears of the non-believers. Now, if you’ll excuse me, my mom says I have to take out the recycling before my next keynote.”

For his part, Kevin Mandelbaum remains optimistic. He just signed up his grandma. “She thinks she’s buying into a time-share in Giza,” he whispered. “But once she sees the power of geometric growth, she’ll thank me. This is my moonshot. Diamond hands, baby. Diamond hands.”

(Featured below is the feature on last week’s pyramid scheme of the week winner)

In a stunning disruption of the financial self-sabotage sector, a new venture has been crowned this week’s most promising pyramid scheme for its revolutionary decision to completely eliminate the product, the pretext, and any lingering shreds of plausible deniability. Apex Ascendancy, a “pre-revenue structural opportunities firm,” is making waves by offering recruits the pure, uncut experience of a pyramid scheme, with no pesky essential oils or cheaply made leggings to get in the way.

“For too long, multi-level marketing has been burdened by the dead weight of ‘things,’” explained founder Skyler ‘Apex’ Finch, 24, from a command center in his step-dad’s pool house. Adjusting his webcam, which was balanced on a stack of Tony Robbins books, he continued, “We asked ourselves: what if we streamlined the process? What if we cut out the middleman—the actual, physical product—and just sold the opportunity to sell the opportunity? It’s the SaaS model, but for financial ruin.”

Apex Ascendancy’s business is built on a single offering: the “Conceptual Upline Packet™.” For an initial investment of $1,999 (payable in Bitcoin, Venmo, or uncashed GameStop shares), new “Independent Structural Consultants” receive a manila envelope containing a laminated stock photo of a bald eagle, a list of their own Facebook friends, and a single, non-toxic crayon for drawing their own success.

“The crayon is key,” Finch stated, his voice resonating with the unearned confidence of a man who lists “crypto visionary” in his Tinder bio. “It symbolizes that you are the architect of your own destiny. Also, we got a great deal on a bulk order of ‘Burnt Sienna.’”

This aggressively pointless venture has found a fervent following among the nation’s burgeoning class of financial daredevils, colloquially known as “regards.”

“I lost my life savings on a Dogecoin spinoff called ‘Elon’sMuskrat’ and then doubled down on Bed Bath & Beyond two days before it was delisted,” said Chad Brogan, 31, a newly minted “Load-Bearing Member” in the Apex Ascendancy hierarchy. “Compared to that, this is the most transparent investment I’ve ever made. The business plan is literally a drawing of a triangle with a dollar sign at the top and a frowny face with my name next to it at the bottom. That’s the kind of solid DD you just can’t get from Jim Cramer.”

Brogan, who operates from a standing desk made from unsold cases of his last venture, a keto-friendly energy drink, spends 18 hours a day “leveraging his social assets,” a term he uses for spamming his high school group chat and cold-messaging LinkedIn connections with the subject line: “U up for a paradigm shift?”

The company’s internal structure is a masterclass in motivational absurdity. Recruits start as “Foundational Sediment.” After roping in five friends or family members, they’re promoted to “Load-Bearing Member.” Achieve a downline of 25 people who have alienated their entire social circles, and you reach the coveted rank of “Cap-Stone God,” a title that comes with a 15% discount on future Conceptual Upline Packets™.

Dr. Alistair Finch (no relation, he insists, threatening legal action), a behavioral economist at the Madoff Institute for Financial Innovation, called Apex Ascendancy “a breathtaking work of art.”

“It’s a perfect vacuum of value,” Dr. Finch explained. “They have achieved what alchemists have sought for centuries: they have created nothing out of something. It’s like watching a car crash in slow motion, but the car is fueled by pure, uncut hubris, and the passengers are all cheering. It’s a flawless case study in trickle-down delusion.”

The company’s appeal to the wallstmemes demographic is potent. For a generation that communicates through rocket emojis and considers a 90% portfolio loss a “dip,” Apex Ascendancy is the ultimate YOLO.

“It’s HODLing, but for people,” commented Reddit user u/DiamondHandedApe420. “Instead of a stock, you’re holding onto the hope that your cousin Terry is dumber than you are. The fundamentals are rock solid.”

Founder Skyler ‘Apex’ Finch sees himself less as a CEO and more as a financial philosopher, liberating the masses from the original pyramid scheme: a stable job.

“Think about it. A 9-to-5 has a CEO, VPs, managers… It’s a pyramid!” he declared in his latest TikTok, filmed while aggressively pointing at text bubbles on the screen. “They make you do ‘work’ for your money. We’ve removed that friction. We are a pure, frictionless system for transferring wealth upwards. We’re not just disrupting capitalism; we’re disrupting the very concept of geometry.”

The market is already responding. A rival startup, The Mobius Strip of Infinite Returns, has emerged, promising a system where you pay the person below you in the hopes that, through a complex dimensional fold, the money will eventually loop back to you. So far, it has only resulted in its founder being paid by himself, minus transaction fees.

As for the future, Finch’s ambitions are limitless. He plans to take Apex Ascendancy public under the ticker symbol WUT and is developing a line of NFTs of the pyramid’s blueprint, each one a unique JPEG of a triangle.

“We are on the ground floor of a top-tier opportunity that is, structurally speaking, all top tier,” Finch mused, staring wistfully at the pool filter. “This isn’t just a business. It’s a movement. A movement of capital from the many to the few—specifically, me.”

Meanwhile, Chad Brogan just successfully signed up his estranged brother-in-law. “He thinks he’s investing in a decentralized social media platform built on the blockchain,” Chad whispered, hastily hiding the crayon. “My wife’s boyfriend thinks I’m an idiot, but he also thought GME was a one-time thing. We’ll see who’s laughing when I’m a Cap-Stone God.”

Latest news

-

Ima Short - February 17, 2026

Wendy’s Down 10%, Closes Hundreds Of Restaurants, Twitter Account Hopefully Next

-

Pen Smith - February 16, 2026

Grok Just Recommended Putting Vegetables Up Your Ass As Official Government Nutrition Advice

-

Ima Short - February 12, 2026

Netflix Stock Is Down 15%, Should You Buy The Dip?