Michael Burry Just Deregistered Scion Asset Management, Is It Time To Short The Big Short Investor?

Latest news

-

Pen Smith - January 13, 2026

-

Bill Fold - January 12, 2026

Government Approves Artist Visas For OnlyFans Models, But There’s One Strict Requirement You Need To Know

-

Marge Incall -

Powell Just Got Subpoenaed, You Won’t Believe His Response

-

Ima Short - January 8, 2026

More Americans Will Die Than Be Born In 2030, Here’s What That Means For The Economy

Why are the only pictures of Burry from the Big Short premiere?

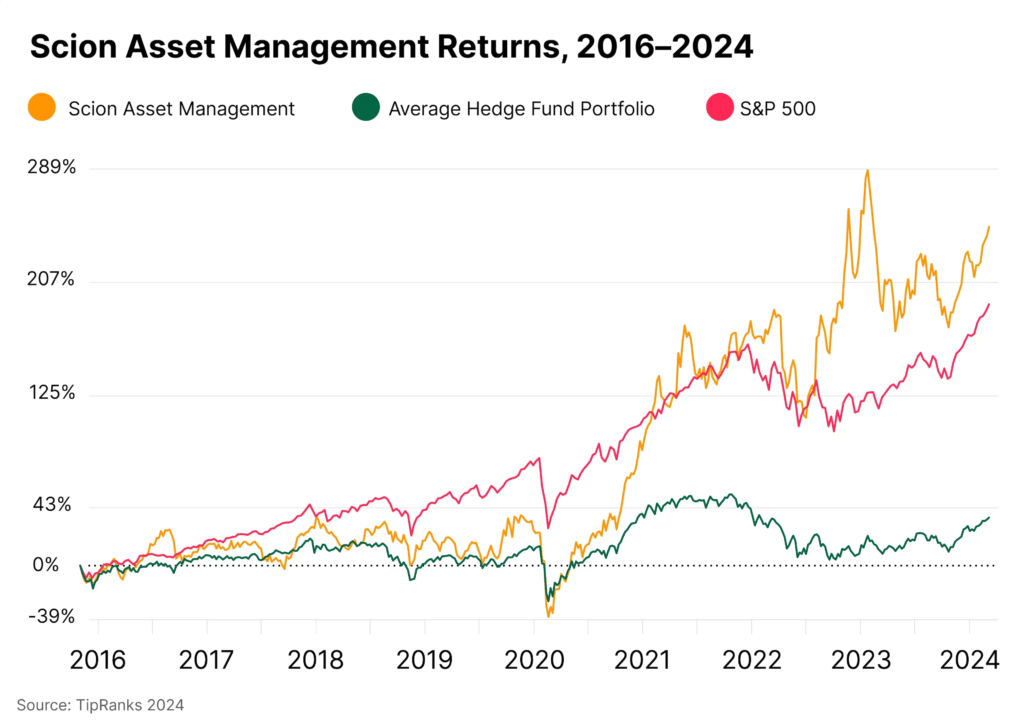

Michael Burry, the famous investor who correctly called the 2008 financial crisis as depicted in The Big Short, has OFFICIALLY deregistered his hedge fund, Scion Asset Management.

As of November 10th, SAM is marked “terminated” by the SEC, meaning that robot Arnold Schwarzenegger finally got to him for predicting the future. Sad.

Who’s to say what will happen to the $155 million in assets managed by the company, not me, I don’t know shit. What you think I got a job writing for ‘Wall Street Memes’ because of my financial expertise? Get real. They’d sooner replace me with an AI except they’re worried they might be assassinated by a robot Arnold Schwarzenegger.

Burry The Headline

Ever since his exploding fame, Burry’s been a bellwether for oncoming financial crises and just last week Burry bet $1.1 billion dollars in money on Nvidia and Palantir stock falling and then what happens?

BOOM.

7.95 points down. Burry, you’ve done it again you son of a bitch, you’ve reallly done it again.

And lately Burry’s been on a rampage on X, posting pictures of Christian Bale, declaring the bubble is about to burst and ringing a big bell screaming “the end is nigh.”

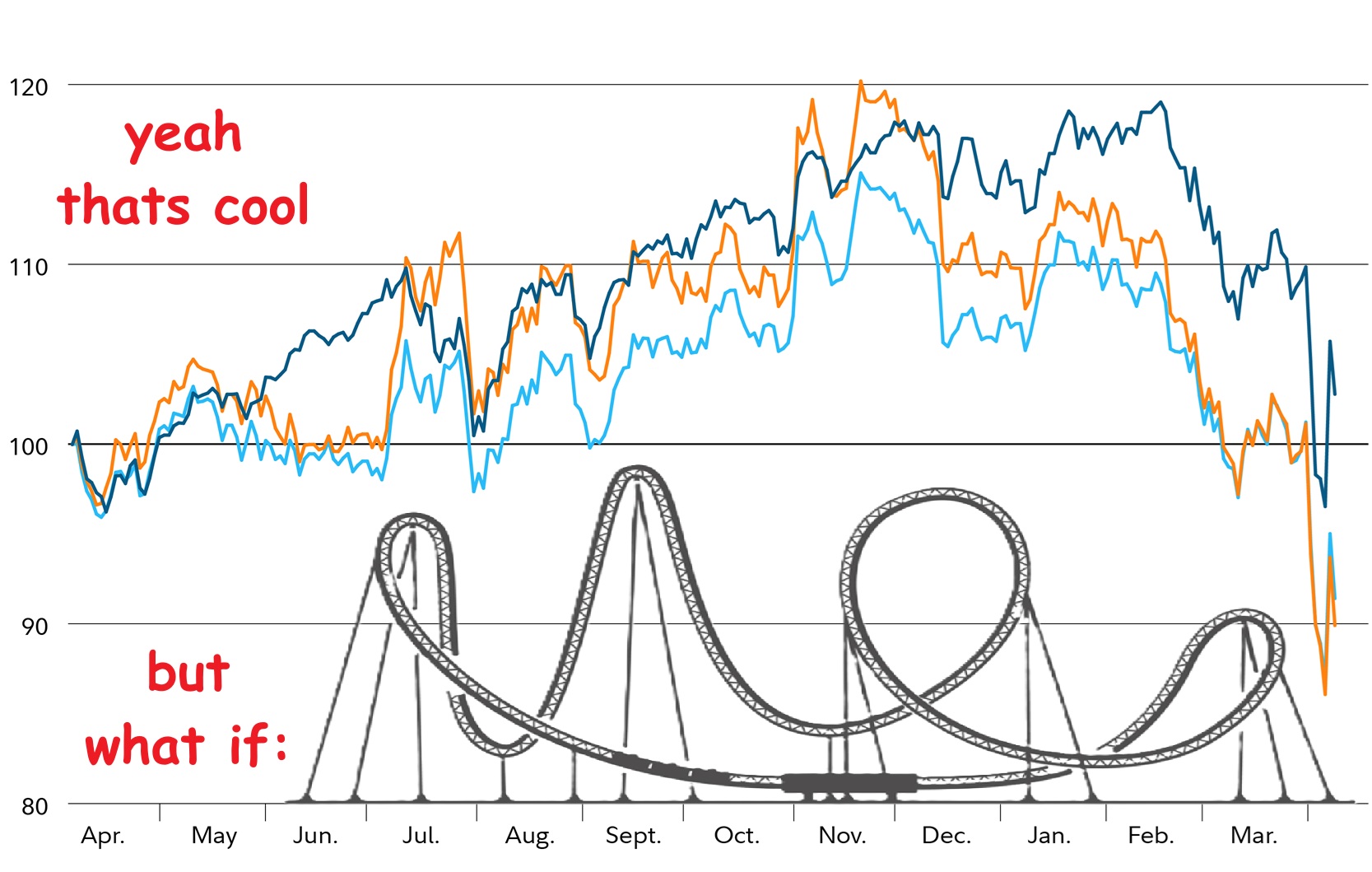

“On Monday, he posted a chart titled “US tech capex [capital expenditure] growth is matching the tech bubble of 1999-2000” and another showing how growth in demand for cloud computing at major tech companies is slowing.”

Cool, cool, cool.

Tbh he’s not a lone Cassandra for once as many economists are pointing out parallels between now and 2008. Nvidia just capped at a $5 trillion valuation amongst plans to invest in every company. Similarly, the US Government has placed big chips on this whole AI thing panning out.

Burry Vs. Buffett

And not to be outdone, the OG GOAT, Warren Buffett, recently dicted his Berkshire Hathaway stocks in favor of a massive cash reserve, and it also got people worried that cash = crash.

Buffett’s investment firm now has a record $381.7 billion cash stockpile, all tied down and waterproof for when the rain’s a-coming. Or hey, maybe this is just prudence, after all, the rest of the economy is up, Berkshire’s stock is down 2% so what do they know?

As this one article I found online explained it nicely, so I’m just going to copy it wholesale:

““If you feel like stocks are expensive, including your own shares, you’re eventually going to be right, but you can be wrong for a long time,” said James Shanahan, an analyst at Edward Jones who recently upgraded Berkshire to a “buy” rating. This echoes Buffett’s history of sitting on cash during frothy markets, only to deploy it during downturns — like the 2008 financial crisis when he snapped up bargains.”

…it’s not plagiarism when they’ve clearly used AI, right?

Buffett (no relation to Jimmy) is due to step down as CEO of his investment firm next May, probably because he’s 95… NINETY FIVE?? Wtf guy? Five years off one hundred and he’s still investing? Still got the moves? Still hustling? Bro, you have enough money, it’s ok, you can retire…

So who’s to say what will happen? Since we’re not big-shot investors, the best we can do is keep our fingers crossed and hope we don’t see ‘The Big Short 2: Electric Boogaloo’ in theatres any time soon.

Latest news

-

Pen Smith - January 13, 2026

Elon Musk Says Don’t Save For Retirement And His Reasoning Is Crazy

-

Bill Fold - January 12, 2026

Government Approves Artist Visas For OnlyFans Models, But There’s One Strict Requirement You Need To Know

-

Marge Incall -

Powell Just Got Subpoenaed, You Won’t Believe His Response

-

Ima Short - January 8, 2026

More Americans Will Die Than Be Born In 2030, Here’s What That Means For The Economy