Is Your Job Just a Ponzi With Extra Steps? Here Are Five Signs

Latest news

-

Bill Fold - February 26, 2026

-

Marge Incall - February 25, 2026

Paramount Finally Offers Better Than Netflix, Will WB Go Back On Their Deal?

Listen up, apes and wage-cucks. You ever sit in your 9-to-5, staring at a spreadsheet that tracks other spreadsheets, drinking coffee that tastes like burnt aspirations, and think to yourself, “What is the underlying asset here? What value am I actually creating?”

You’ve diamond-handed your stapler through three “re-orgs” and listened to your boss drone on about “synergy” until your ears bled. You’ve been promised tendies in the form of a 3% annual raise that doesn’t even beat the inflation on a pack of gum.

What if we told you that your “stable career” isn’t a wealth-building vehicle, but a masterfully crafted, slow-motion Ponzi scheme with better branding and a 401(k) match?

A Ponzi scheme relies on new money to pay off the early investors. Sound familiar? Here are five signs your job might just be a Ponzi with an HR department and casual Fridays.

1. The “Early Investors” (aka The C-Suite) Get Rich by Doing Nothing You Can Understand

In a classic Ponzi, the guy at the top—let’s call him Bernie M.—collects all the cash while telling everyone about his brilliant, secret strategy.

In your company, this is the C-Suite. What does the Chief Synergy Officer actually do? Nobody knows. He appears once a quarter on a Zoom call from his yacht to say things like, “We’re leveraging our core competencies to actualize a new paradigm of growth.” This is the corporate equivalent of “Trust me, bro, the returns are guaranteed.”

Meanwhile, you’re the “new money.” Your 60-hour work week, your cancelled weekend plans, your soul-crushing PowerPoint decks—that’s the fresh capital that funds the CEO’s bonus, which he uses to buy another vacation home in a state you can’t afford to visit. The early investors are living large while you’re just keeping the lights on.

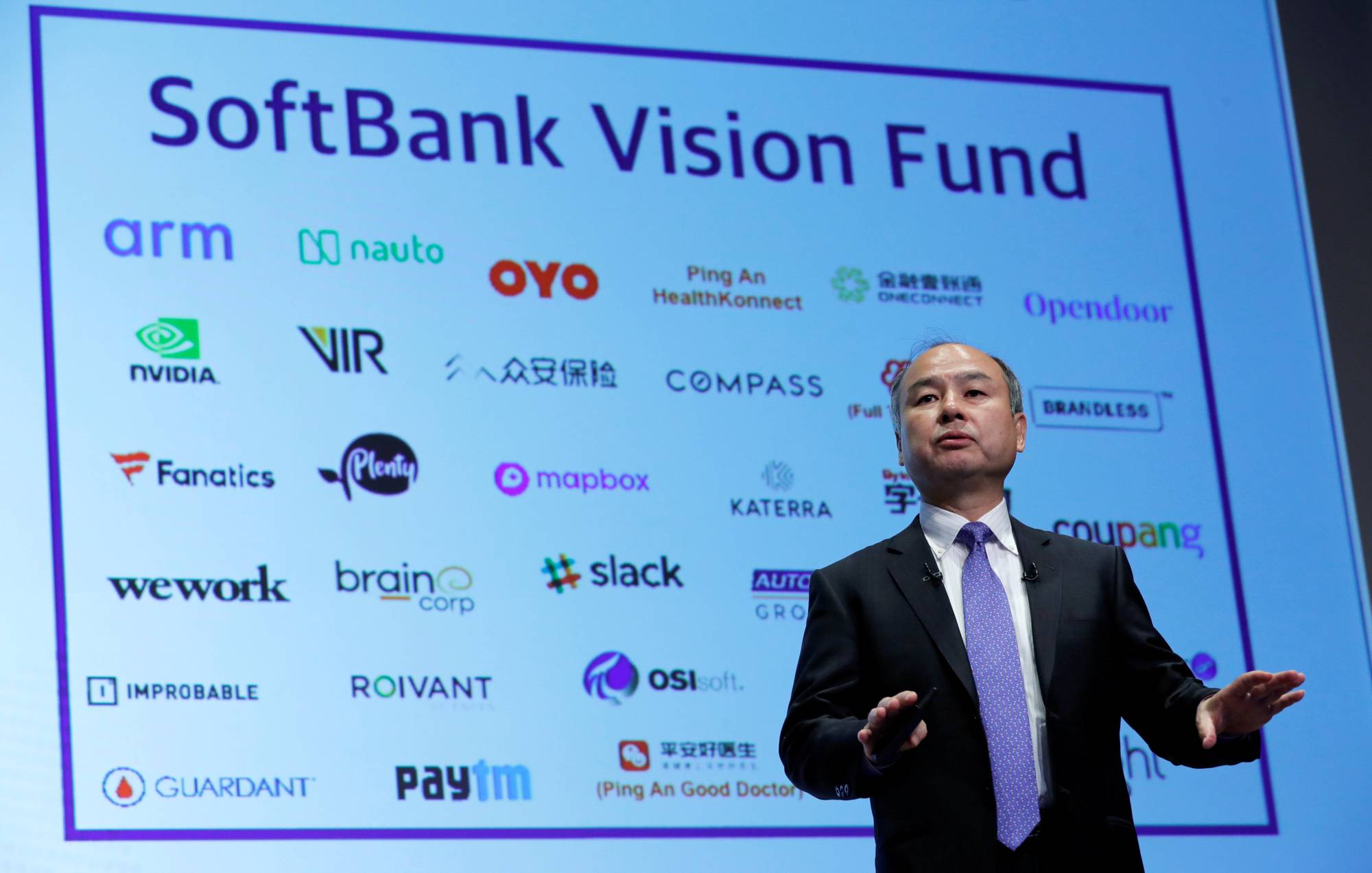

2. The Entire System Relies on a Constant Influx of “New Money” (aka New Hires)

A Ponzi collapses the second it can’t attract new investors. Your company would collapse the second it can’t attract fresh-faced college grads willing to trade their youth for a branded water bottle and “invaluable experience.”

Notice how your company is always hiring? That’s because the churn is real. People burn out, realize the game is rigged, and leave (or get “rugged”). The company needs to constantly replace them to keep the machine running. They bring in new blood, full of hope and a lower salary expectation, to do the work that pays the salaries of the managers above them, who in turn are paying the salaries of the VPs above them.

That “Employee Referral Bonus” they offer you? That’s not a perk. That’s a commission for recruiting another sucker into the downline.

3. The “Investment Strategy” is Incomprehensible Corporate Jargon

Ponzis work by baffling you with complexity. “We use a split-strike conversion arbitrage strategy that’s proprietary.” It means nothing, but it sounds smart enough to make you hand over your life savings.

Your job does the same thing, but it’s called “corporate-speak.”

“We need to circle back and touch base offline to operationalize our deliverables and ensure we’re all aligned on the go-forward strategy.”

This is a sentence that took six people in a two-hour meeting to construct, and it means, “Let’s talk later.” The purpose of this jargon isn’t to communicate; it’s to create a facade of intellectual importance around tasks that are, at their core, moving numbers from one box to another. It makes you feel like you’re part of a sophisticated operation, not just a cog in a machine that sells slightly different widgets than the other guy.

4. The Promised Returns (aka “Promotions”) Are Always Just One More Quarter Away

Every Ponzi promises incredible returns that are perpetually just around the corner. “Just stay invested,” they say, “the big payout is coming.”

At your job, this is the “career ladder.” It’s the vague promise that if you just “crush it” for one more quarter, if you just take on one more project without complaint, if you just laugh at your boss’s terrible jokes a little harder, that promotion to “Senior Associate Analyst II” will be yours.

But the goalposts always move. The promotion gets pushed back. The budget gets “tight.” They need you to “show more leadership” (i.e., do a manager’s job for an analyst’s pay). You’re chasing a carrot on a stick, and the stick is held by a guy who’s already cashed out. They’re not paying you with money; they’re paying you with the hope of future money. It’s the professional equivalent of HODLing a shitcoin that’s been trading sideways since 2018.

5. The Inevitable Collapse is Called a “Restructuring” or “Layoff”

When a Ponzi runs out of new money, the whole thing spectacularly implodes. The late-stage investors lose everything.

When your company misses its growth targets for two quarters in a row, it doesn’t just implode. It does something far more sterile and cruel: it “restructures.” This is a corporate rug-pull.

The “early investors” (the execs) are safe. They already got their multi-million dollar bonuses last year. They’ll fire a bunch of “late-stage investors” (you and your team), call it “trimming the fat,” and then give themselves a “retention bonus” for navigating the company through “tough times.”

You’re left with a cardboard box of your personal effects and a LinkedIn post about being #OpenToWork, while the masterminds of the scheme sail off into the sunset on their golden parachutes.

So what’s the takeaway?

At least with a crypto Ponzi, you know you’re gambling. Here, you’re trading the one non-renewable resource you have—time—for the illusion of stability.

So next time you’re in a meeting that could have been an email, just smile to yourself. You’re not just an employee. You’re an investor in one of the most successful, long-running Ponzi schemes in human history. Now go update your resume.

Godspeed, losers.

For more (not) financial advice, click here: This Week’s Top 6 Ponzi Schemes To Invest In

Latest news

-

Bill Fold - February 26, 2026

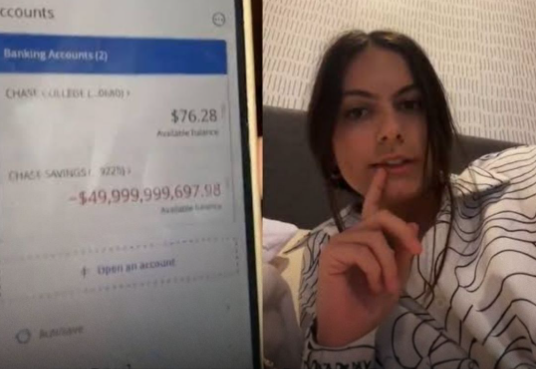

Logan Paul’s Record-breaking Pokémon Card Buyer Just Got Unmasked And You’ll Never Guess Who It Is

-

Marge Incall - February 25, 2026

Paramount Finally Offers Better Than Netflix, Will WB Go Back On Their Deal?