Get Rich Quick: Warren Buffett’s Secret Betting Tips

Latest news

-

Pen Smith - February 18, 2026

-

Ima Short - February 17, 2026

Wendy’s Down 10%, Closes Hundreds Of Restaurants, Twitter Account Hopefully Next

-

Pen Smith - February 16, 2026

Grok Just Recommended Putting Vegetables Up Your Ass As Official Government Nutrition Advice

For decades, the investing world has been divided into two camps: the slow-and-steady, dividend-reinvesting boomer camp led by Warren Buffett, and the YOLO-ing, 100x-leverage, meme-coin-apeing degen camp led by us.

Until now.

In a discovery that is already being called “the Dead Sea Scrolls of getting rich,” a crumpled, ketchup-stained document believed to be a Dairy Queen napkin was recovered from a trash can outside Berkshire Hathaway headquarters. Scrawled on it, in what experts believe is the Oracle of Omaha’s own hand, are five principles that finally translate his legendary wisdom into a language today’s traders can understand.

Forget everything you thought you knew. Here are Warren Buffett’s secret tips for absolutely crushing the market.

1. Only Invest Within Your “Circle of Competence”

For years, Buffett has said he only invests in businesses he can understand, like insurance or railways. The modern translation? Only invest in memes you genuinely get.

Don’t understand the nuance of the latest cat-themed Solana coin? Stay away. But if a coin is based on a cartoon frog you’ve been posting for years, or a stock is surging because a guy on Reddit made a funny MS Paint drawing? That’s your circle of competence. That’s your Coca-Cola. Go all in. Your gut-level understanding of the meme’s virality is the only “fundamental analysis” you need.

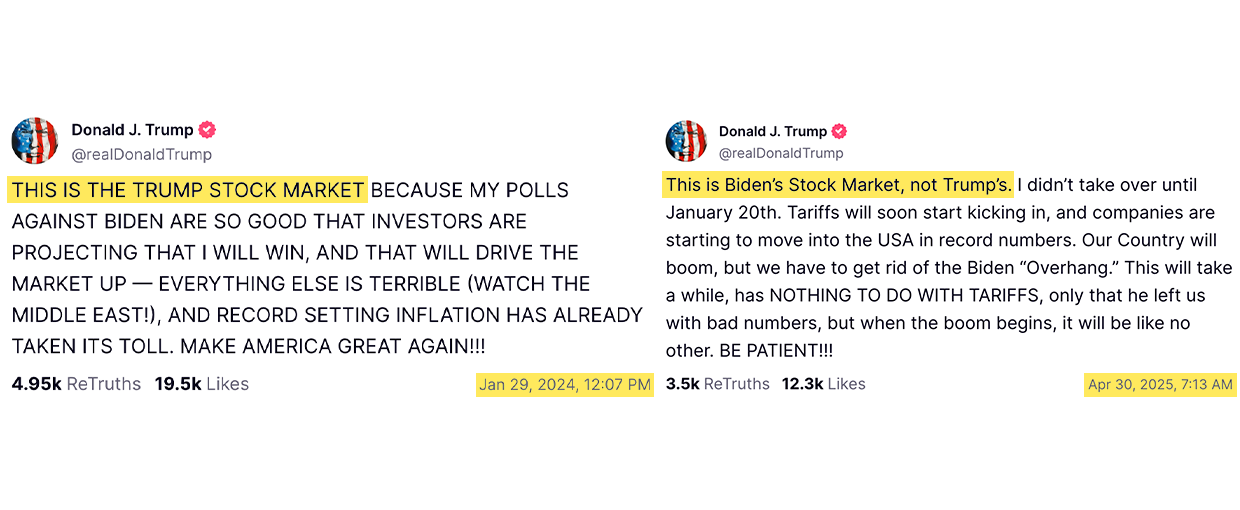

2. Be Greedy When Others Are Fearful (of Missing Out)

The old interpretation was to buy when there’s blood in the streets. The real meaning is much simpler: When the FOMO in your group chat reaches a fever pitch, you must be greedier than anyone else.

Is everyone posting screenshots of their 500% gains? Are rocket emojis flooding your feed? That’s not a sign of a top. That’s the market screaming at you to be fearful… fearful that you’re not taking out a second mortgage to buy more. True Buffet-tier investors understand that the moment of maximum greed is the real generational buying opportunity.

3. Our Favorite Holding Period is “Until It Hits Zero or We’re Forced to Sell for Tax-Loss Harvesting”

Buffett famously said his favorite holding period is forever. Apes call this “diamond hands.” But the napkin reveals the true genius behind this strategy.

It’s not about long-term value. It’s about refusing to admit you were wrong. Selling at a 90% loss is for paper-handed cowards. A true value investor holds on, not because they believe in the asset, but because locking in a loss would damage their ego. The real “value” you get is the moral victory of going down with the ship.

4. It’s Far Better to Buy a Wonderful Meme at a Terrible Price Than a Terrible Meme at a Wonderful Price

A “wonderful meme” has a great community, a catchy name, and high-quality GIFs. A “terrible meme” is one that has actual utility or a business plan.

According to the sacred napkin, paying the absolute top for a coin like $DOGE in 2021 was a far superior investment to buying a boring, functional crypto project at the bottom. Why? Because for a brief, shining moment, you were part of something. You were part of the culture. And the memories of being up 10x for three hours are a “moat” that no bear market can ever take away.

5. Price is What You Pay. Clout is What You Get.

This might be the most profound revelation of all. Buffett’s old-fashioned ideas about “intrinsic value” are dead. You’re not buying a future cash flow stream. You’re buying a story.

Did you lose $5,000 on 0DTE GameStop options? Wrong. You paid $5,000 for a legendary story about how you fought the hedge funds, an anecdote you can tell for years. The “value” isn’t in the money; it’s in the upvotes, the retweets, and the respect you get from other financial deviants.

When reached for comment, Buffett’s long-time partner Charlie Munger, who was seen exiting the Dairy Queen shortly after the napkin was discovered, simply said, “Warren’s right. Now if you’ll excuse me, I have to go 100x leverage my See’s Candies position. To the moon.”

So there you have it, you going to send your tendies to the moon or whatever it is you people say? Yeah, we thought so.

Want more Buffett, you saucy minx? Click here: Buffett Just Cashed Out $300B Then Retired, Here’s How He Pulled It Off

Latest news

-

Pen Smith - February 18, 2026

Meta Patents AI To Run Accounts After Death, Black Mirror To Sue For Plagiarism

-

Ima Short - February 17, 2026

Wendy’s Down 10%, Closes Hundreds Of Restaurants, Twitter Account Hopefully Next

-

Pen Smith - February 16, 2026

Grok Just Recommended Putting Vegetables Up Your Ass As Official Government Nutrition Advice