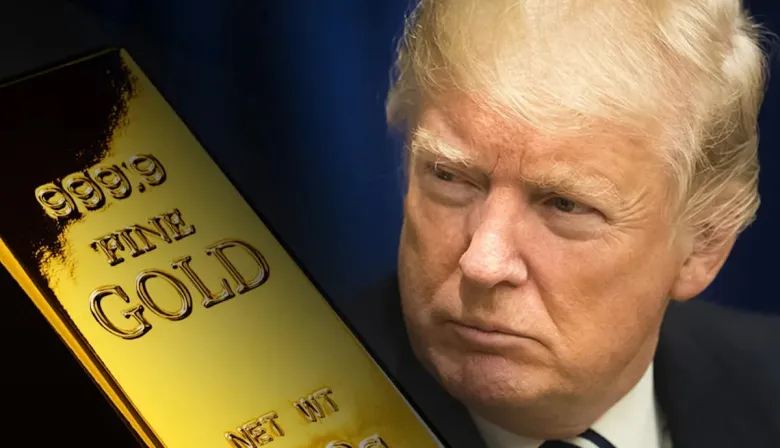

Gold Just Hit $5,100 For The First Time, Here’s Two Other Times It’s Predicted A World War

Latest news

-

Pen Smith - March 5, 2026

-

Bill Fold - March 4, 2026

Barron Trump Bought $30m In Oil 2 Days Before War, Did He Know Something We Didn’t?

Silver and bronze take second and third place, respectively

Gold (GLD) continued its meteoric rise over the weekend to become one of the most valuable metals in the world, beating out other popular metals like zinc, stainless steel and thallium.

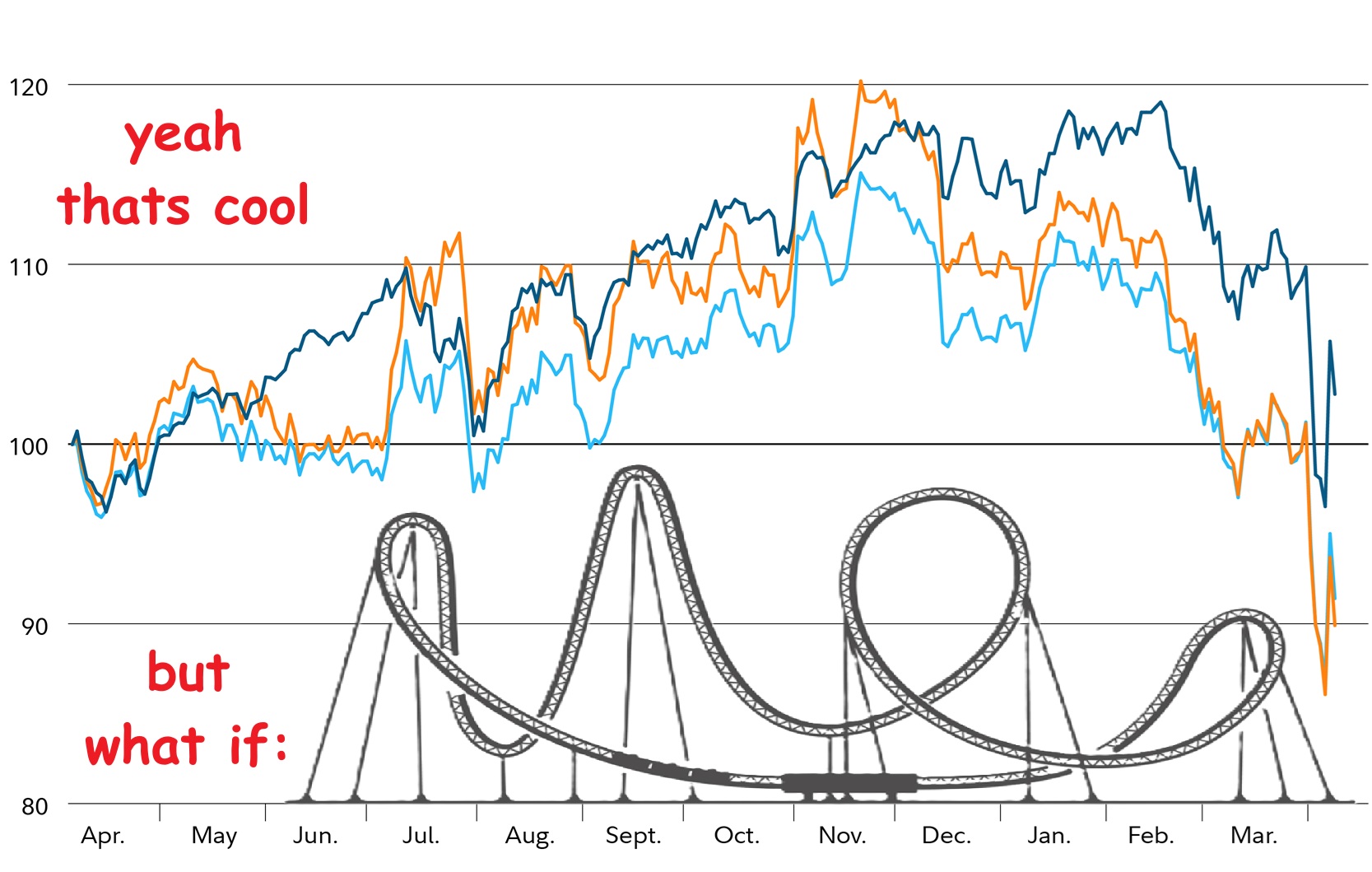

This first time, all-time high (ATH) is part of an ongoing rally caused by uncertainty in the US dollar (USB), caused by uncertainty in the markets generally, caused by tariffs and all that Greenland stuff, which was caused by Trump, which was caused by his mother probably not hugging him enough as a kid or something.

And whilst fictional characters like Scrooge McDuck and Goldfinger are rolling in a big pile of money right now, not everyone’s so chipper about the sitch.

Robin Brooks, Senior Fellow at the Brookings Institution, explains that, “The rise in precious metals prices is breathtaking and profoundly scary [and] part of something much bigger…”

Ok, that’s not ominous at all.

“We’re at the start of a global debt crisis,” he continued, “with markets increasingly fearful governments will attempt to inflate away out-of-control debt.”

Oh shit, what?? Why did no one tell me this?!?!

“A falling dollar will super-charge the rise in gold prices and the debasement trade [that’s buying gold when the economy’s bad like in times of war because it’s more stable than the dollar or bitcoin or whatever btw Robin Brooks didn’t say any of this, I’m adding this in here, I’ll let him talk now…] because it boosts the purchasing power of non-dollar buyers,” Brooks wrote.

Gold And Days

It’s true that during major conflicts, gold rallies. During world war one, world war two and the civil war we saw this first hand… well, not first hand, we weren’t there. Well, I’m assuming you weren’t there. I wasn’t there. If I had been though I probably would have bought some gold.

On that point, the Dow Jones to Gold ratio is now at a level only seen 4 times in history: 2026, 2008, 1973 and 1929. Every single time this has happened it’s marked a fundamental change to the economic system: the Banking Act of 1933, the Convertibility of the Dollar 1971 and the Economic Stabilization Act of 2008.

Now, what does this mean? Is World War 3, the big triple double-ya, or some other market crash on the horizon? Well, probably not, but either way, this gold rally wouldn’t predict it. These markets are reactive, not predictive. The gold isn’t saying there will be war, it’s saying there is war right now. …hadn’t you noticed?

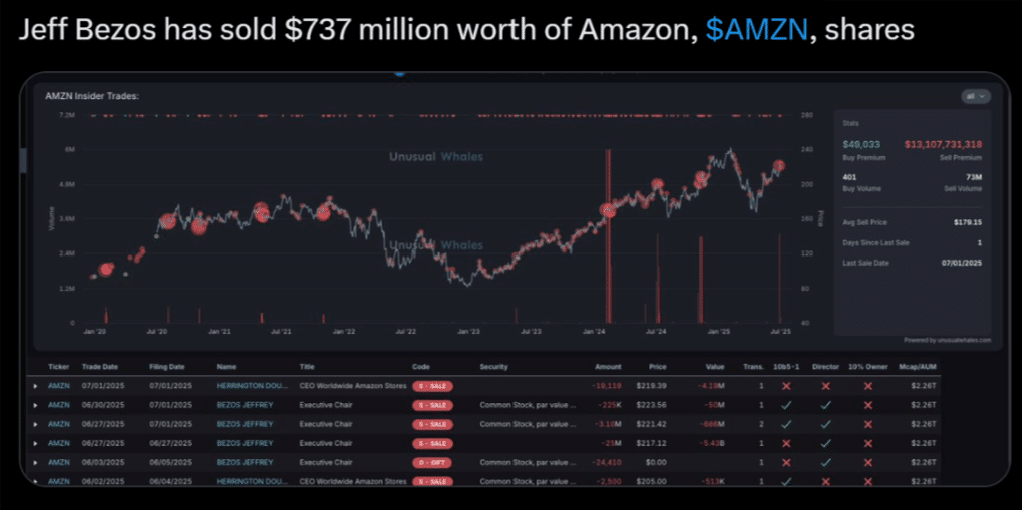

SO, who’s to know if we’re in for another financial crisis or not. Either way, just rest assured that unless you’re a billionaire, you will suffer worst and suffer first.

Latest news

-

Pen Smith - March 5, 2026

Big Tech Signs Trump’s Pledge To Limit AI Energy Costs, But Will It Work?

-

Bill Fold - March 4, 2026

Barron Trump Bought $30m In Oil 2 Days Before War, Did He Know Something We Didn’t?