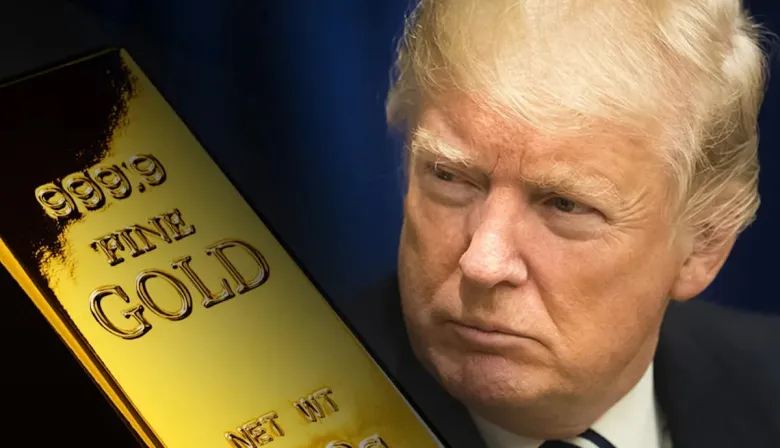

Gold & Silver Just Reached A Staggering ATH, Here’s 5 Reasons Why Economists Are Losing Their Minds

Latest news

-

Ima Short - March 2, 2026

-

Bill Fold - February 26, 2026

Logan Paul’s Record-breaking Pokémon Card Buyer Just Got Unmasked And You’ll Never Guess Who It Is

Gold, silver, bronze, nickel, everyone has a favorite metal but did you know that there’s more to metals than just shiny-shiny-clunk?

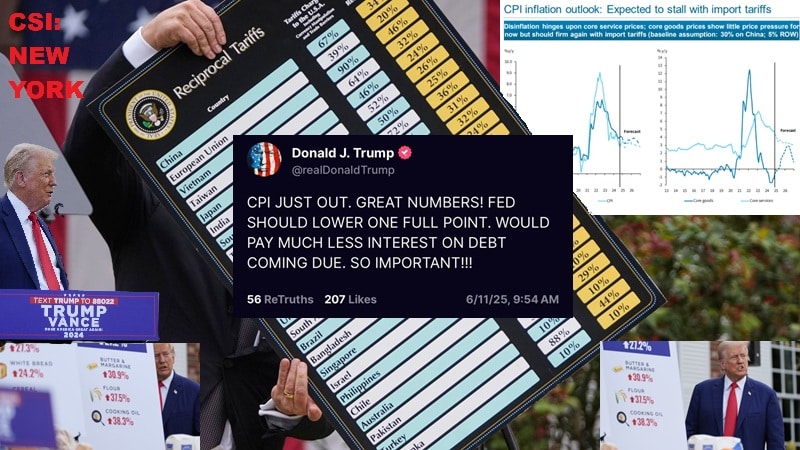

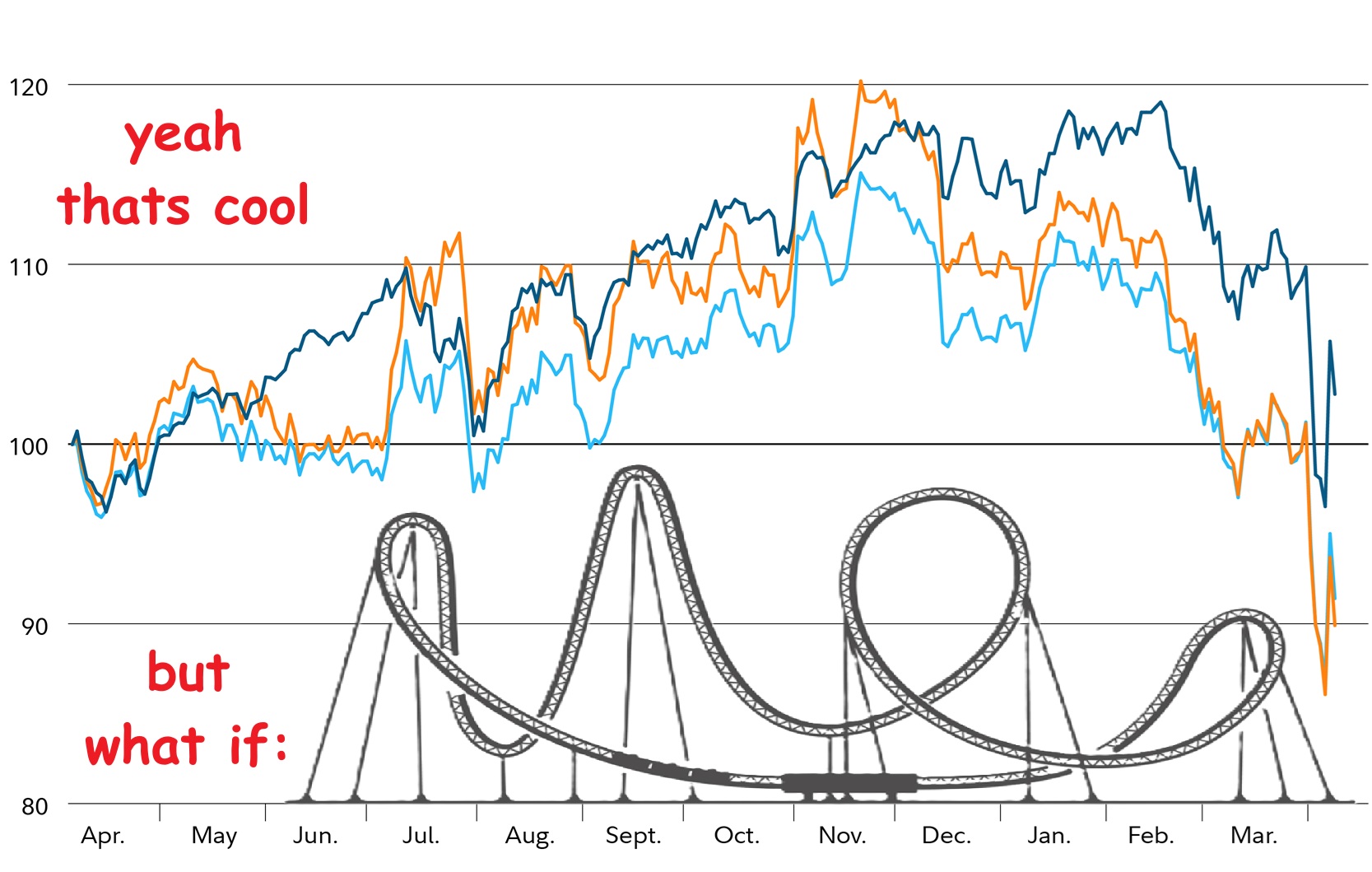

Yes, as Trump’s latest tariffs send gold and silver rocking to unprecedented ATHs we think it’s time to look back on the top five reasons why that’s probably a bad thing actually.

5. Soaring gold weakens the dollar

In short, gold is a more stable currency whereas everything else from dollars to Bitcoin are a bit more volatile. This means that when the economic forecast is more uncertain, investors will transfer their funds from dollars into less risky options like gold, meaning the almighty USD takes a massive hit.

4. Gold is now worth more than gold

It’s one of those classic economic paradoxes that no one has been able to solve. If gold is worth its weight in gold but then it becomes worth more, what’s it worth its weight in now? Diamonds? Human souls? Eggs? It’s hard to tell.

3. A gold boom is a recession indicator

Pride commeth before a fall and gold commeth before a market fall. For the reasons listed above, a big gold boom might be good for pawnshops but it’s an ill omen for the state of the economy and might signal a recession in the near future.

2. What am I supposed to do with all those gold rings I was planning to buy? I was planning to buy like fourteen golden rings, one for each finger and now what I’m supposed to do? THE WEDDING IS IN FIVE MINUTES I’M GOING TO BE LATE!

I cant afford all those rings now. Donald Trump, you have RUINED my special day.

1. We don’t know anything

Like, yes, we can imply some stuff from these developments, but no one, especially not economists have a crystal ball. Who knows what will happen with the economy, especially as Trump might reverse these tariffs on a whim like tomorrow and gold will fall again.

Let’s just buckle up and strap on for the ride.

Latest news

-

Ima Short - March 2, 2026

Amazon Cloud Services Down AGAIN, But This Time They Have A Good Excuse

-

Bill Fold - February 26, 2026

Logan Paul’s Record-breaking Pokémon Card Buyer Just Got Unmasked And You’ll Never Guess Who It Is