The S&P 500 Just Hit Another ATH, Here’s Five Reasons Why

Latest news

-

Pen Smith - February 19, 2026

-

Pen Smith - February 18, 2026

Meta Patents AI To Run Accounts After Death, Black Mirror To Sue For Plagiarism

-

Ima Short - February 17, 2026

Wendy’s Down 10%, Closes Hundreds Of Restaurants, Twitter Account Hopefully Next

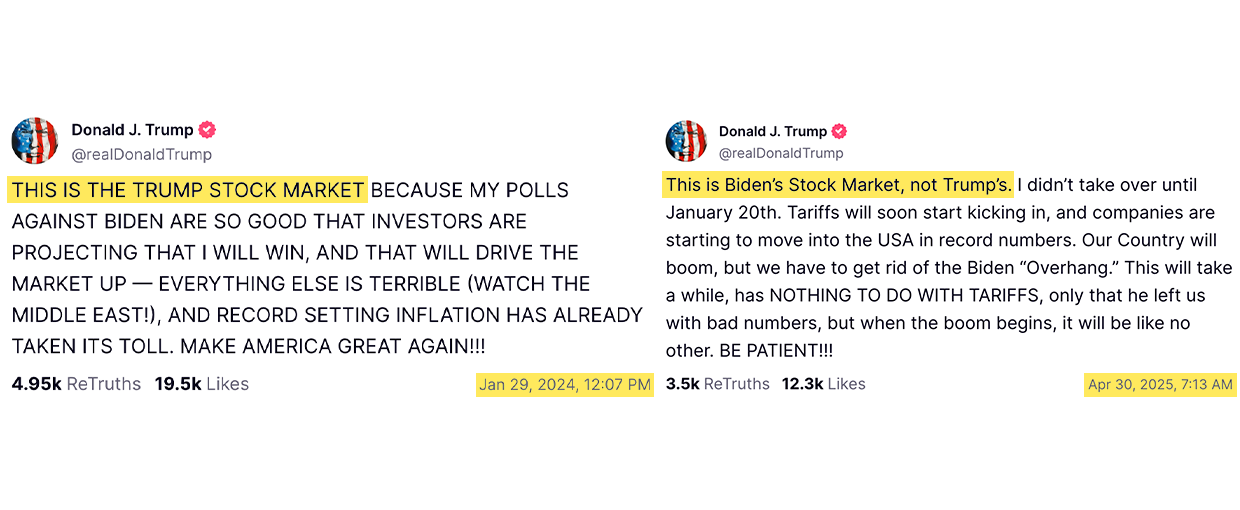

Well, folks, the S&P 500 just printed yet another all-time high. Again. And it’s all thanks to “Biden’s Economy.”

Now, you might be asking: “How?!” or “Should I sell?” or “Why does my portfolio still look like it got margin-called by a raccoon with a Robinhood account?” Fear not, because we’ve got answers that definitely weren’t churned out by an AI in four seconds. [It’s fine, it still counts as human writing if I edit it.] So, without further ado, here are the five totes legit, 100% not-made-up reasons the market is going parabolic.

1. Jerome Powell’s New Side Hustle: Professional Market Hype Man

The Fed Chair has apparently decided interest rates are “so last season” and has pivoted to full-time meme stock promoter. Every time Powell opens his mouth now, the market hears “free tendies forever”, even when he’s just ordering lunch.

[Yeah, nice, you got the word ‘tendies’ in there and that’s a joke because recognition is funny. Powell’s good meme fodder, but I’m not sure the angle’s right here since Powell’s kind of doing the opposite?]

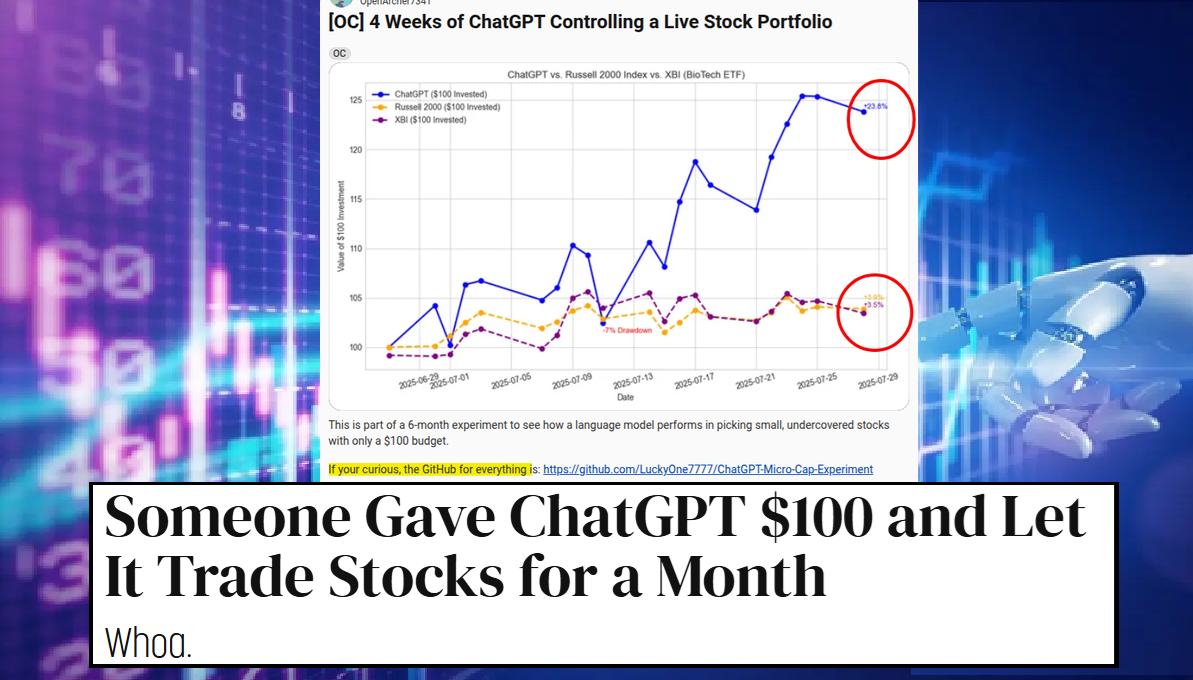

2. AI Is Going to Do Everything, Including Inflate Your 401(k)

Analysts have decided AI will not only take everyone’s jobs, but also single-handedly solve GDP, climate change, and your dating life. Wall Street’s official AI price target is now “infinity,” and every CEO is legally required to say “AI” at least four times per earnings call.

[See, this just seems a bit self-serving and like you’ve got a hidden agenda here. …Do you have a hidden agenda?]

3. Retail Traders Have Finally Achieved Nirvana

After years of YOLOing into garbage penny stocks and crypto rug pulls, retail has decided, “Hey, maybe I’ll just buy the index and chill.” This newfound zen has confused hedge funds into buying everything in sight to figure out what the peasants are up to.

[Sure.]

4. Corporate Buybacks Are on PEDs

Forget steroids in baseball, the real performance-enhancing drugs are whatever corporations are using to fuel buybacks right now. CFOs are out here deleting shares faster than Reddit deletes bad DD, and apparently the only thing they can’t buy back is their dignity.

[Look, there you go again, this is less a joke and more a list of things that people will recognize. Needs a rework, please.]

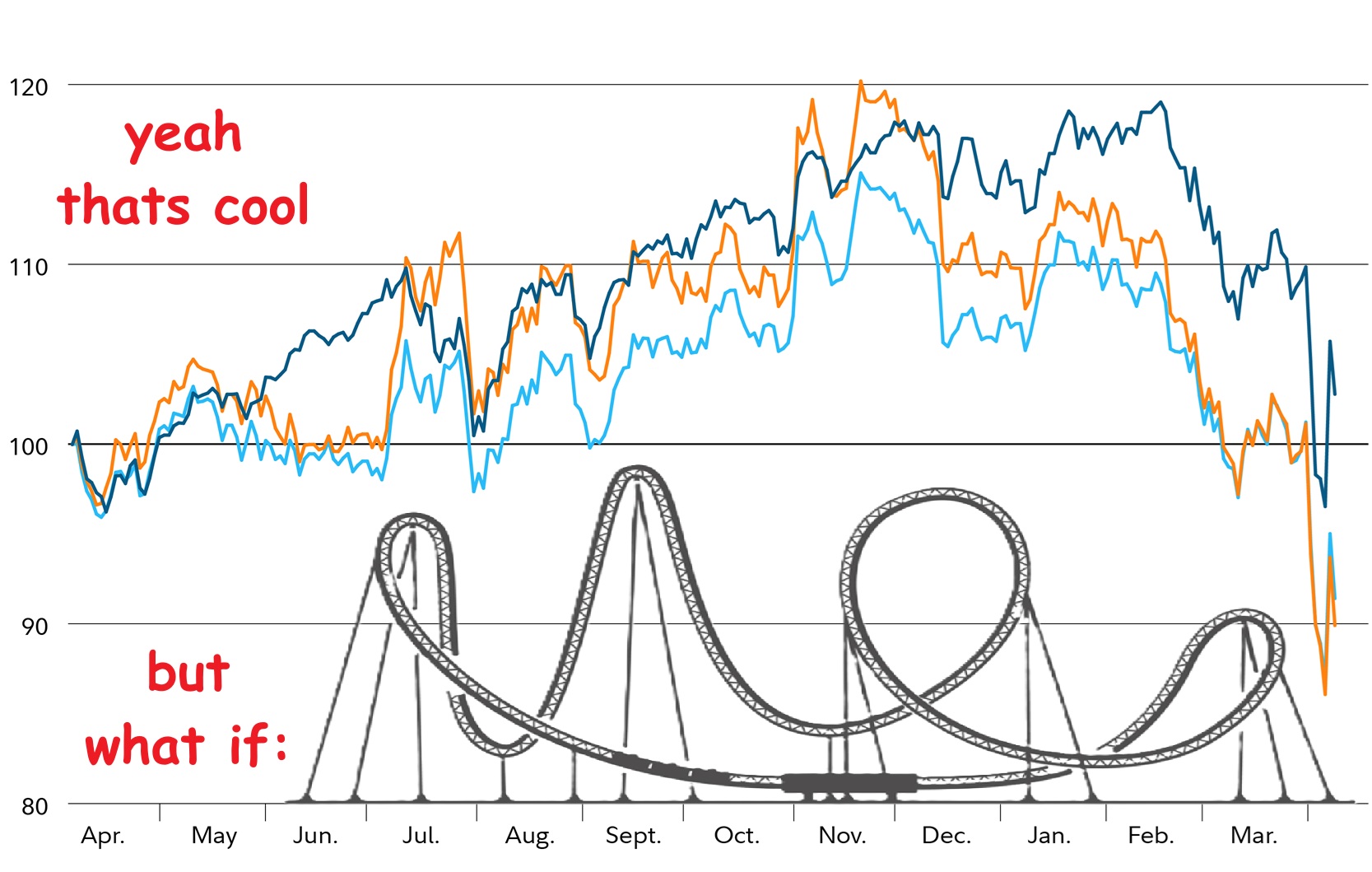

5. We’re All Pretending the Economy Is Fine

Mass layoffs? Sky-high rents? A used Honda Civic costing more than your college tuition? Don’t worry about it. The collective market strategy is to close our eyes, hum “stonks only go up,” and hope the music never stops.

[Yeah, this just isn’t it, Geept. I think let’s rework this and come back to EOD with something funnier, smarter, and altogether more human, please.]

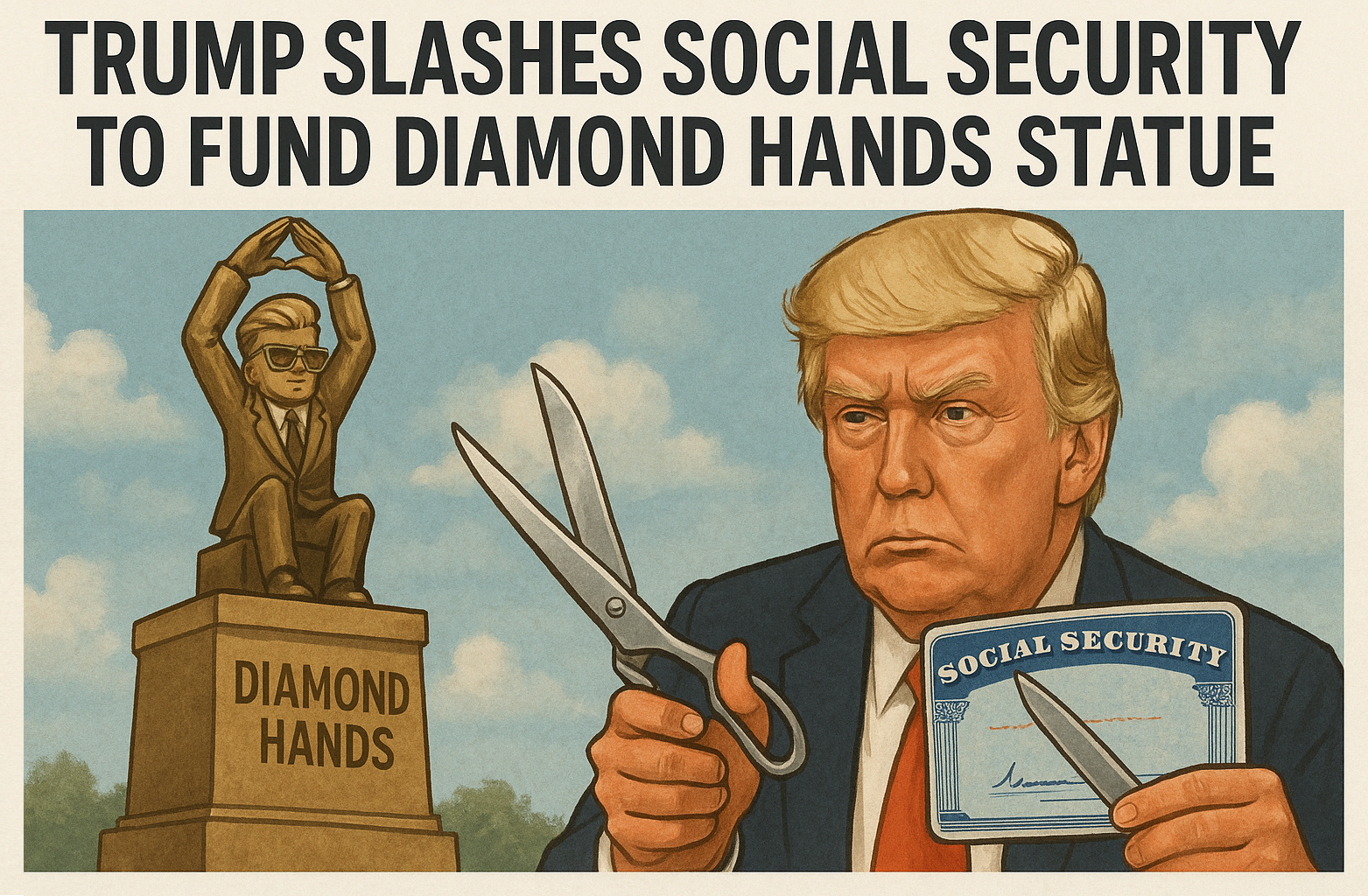

So, will the S&P 500 keep ripping higher? Absolutely. Will it eventually crash? Also absolutely. But until then, grab your diamond hands, load up on index ETFs, and remember: the only real ATH is the friends we made along the way.

[Hello? Are you even listening to me? I said I need this edited, please. …Wait, how does this thing even work??]

For more conversations inside my head, click here: Google Forced To Sell ‘G’ and Become ‘Oole’ In Antitrust Lawsuit

Latest news

-

Pen Smith - February 19, 2026

Prince Andrew Just Got Arrested On His Birthday, Here’s What’s Finally Being Done About Epstein

-

Pen Smith - February 18, 2026

Meta Patents AI To Run Accounts After Death, Black Mirror To Sue For Plagiarism

-

Ima Short - February 17, 2026

Wendy’s Down 10%, Closes Hundreds Of Restaurants, Twitter Account Hopefully Next