Tesla FSD12 to Mimic Human Drivers: Why We’re Doomed

Latest news

-

Pen Smith - July 18, 2025

-

Max Profit - July 17, 2025

Coca-Cola To Change Recipe Back To Cocaine, Trump Takes Credit

-

Ima Short - July 16, 2025

Jerome Powell Is Getting Fired, Here Are The Top 5 Likely Replacements

-

Max Profit - July 15, 2025

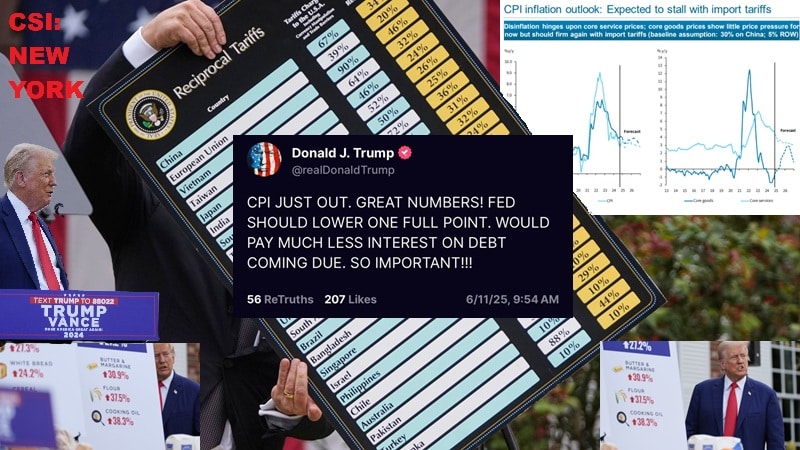

Trump FURIOUS With Positive CPI

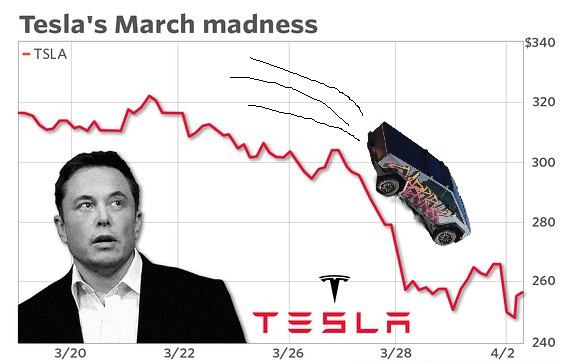

Tesla’s latest Full Self-Driving (FSD) update, FSD12, promises to mirror human driving behaviors so closely, we might as well throw road rules out the window. Scheduled for release in a mere two weeks, this update shifts from traditional code-heavy development to an approach more reminiscent of a teenager learning to drive by watching YouTube.

The Learning Curve: A Steep Drop into Chaos

FSD12’s groundbreaking learning algorithm is set to absorb millions of videos from Tesla drivers worldwide. While this might sound innovative, it’s essentially preparing to learn all the bad habits that make human drivers a menace on the roads. Blinker usage? A thing of the past. Staying in one’s lane? Optional, especially if there’s an urgent text or a fascinating billboard. Speed limits? More like speed suggestions.

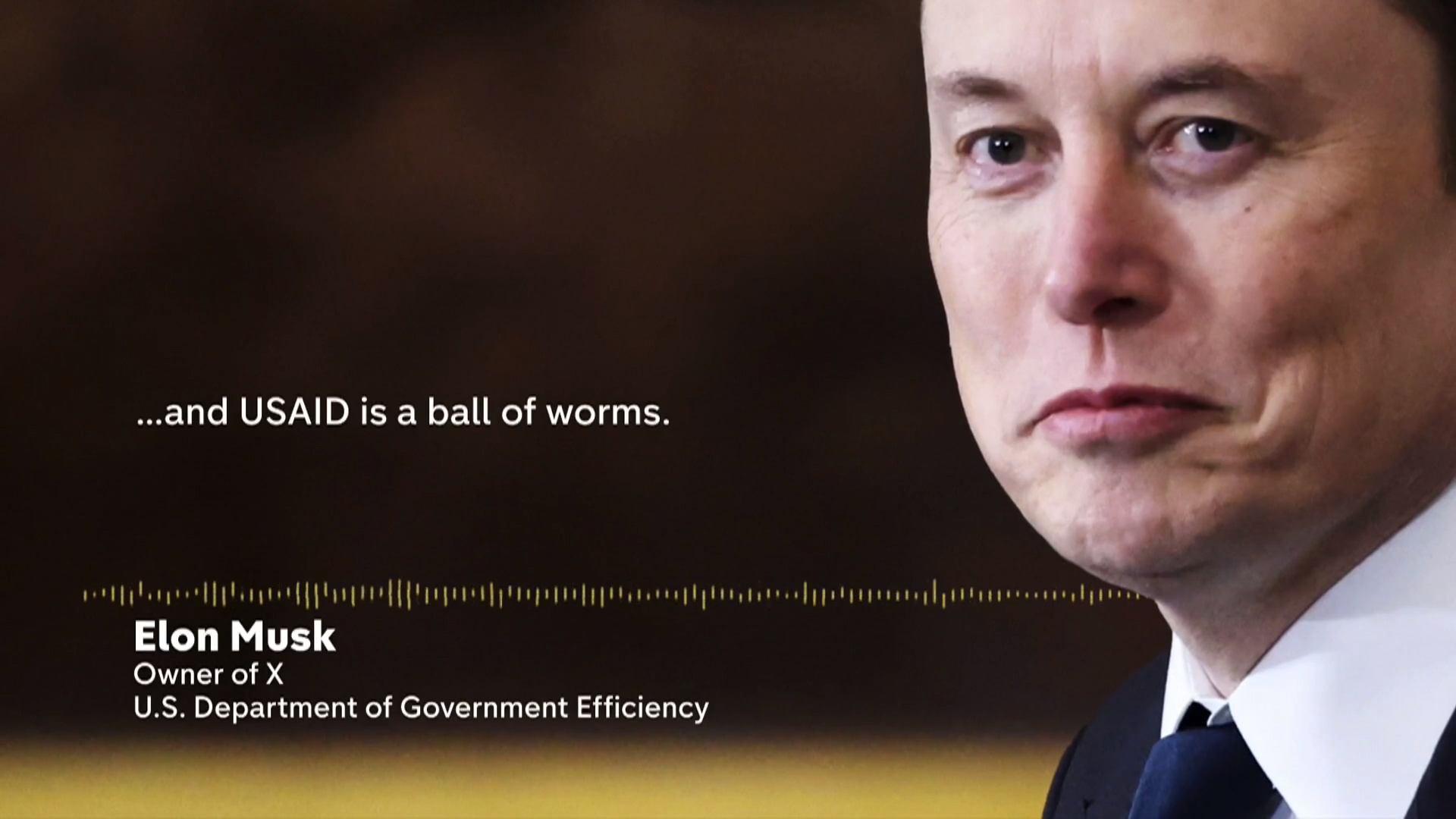

Live Demo: A Wild Ride with Musk

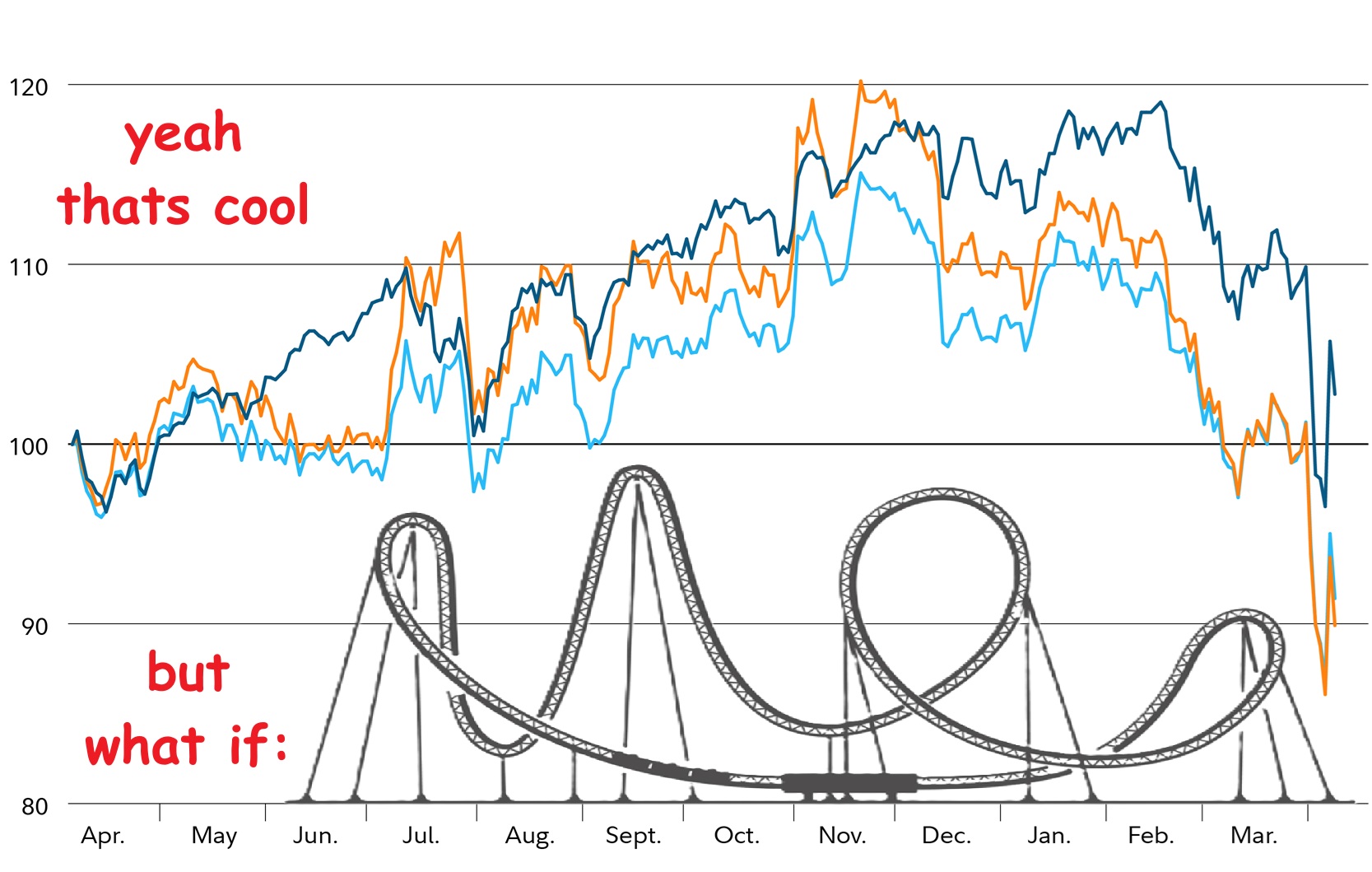

Elon Musk, in his typical showman fashion, debuted the FSD12 update in a livestream that turned into a heart-stopping rollercoaster. Viewers watched with a mix of horror and amusement as Musk narrowly prevented the Tesla from running a red light and making an impromptu pit stop at Chipotle – because who doesn’t crave a burrito while testing groundbreaking AI?

The Future of Driving: A Nightmare?

As we brace for the arrival of FSD12, one can’t help but wonder if Tesla’s vision of the future includes a world where cars honk obscenities, casually speed, and treat driving guidelines as mere suggestions. In this new era, the term “autopilot” might just become synonymous with “your guess is as good as mine.”

it’s clear that Tesla is not just revolutionizing transportation; it’s also inadvertently championing a return to the wild, wild west of driving. Seatbelts fastened, everyone – it’s going to be a bumpy ride.

Latest news

-

Pen Smith - July 18, 2025

10 Revelations From The Epstein List That Someone Just Emailed Us

-

Max Profit - July 17, 2025

Coca-Cola To Change Recipe Back To Cocaine, Trump Takes Credit

-

Ima Short - July 16, 2025

Jerome Powell Is Getting Fired, Here Are The Top 5 Likely Replacements

-

Max Profit - July 15, 2025

Trump FURIOUS With Positive CPI