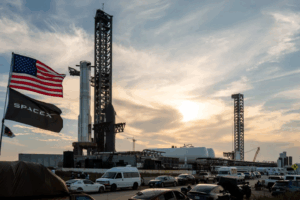

SpaceX Boom Pushes Elon’s Fortune To $684b, Here’s Five Countries He Can Now Buy

Latest news

-

Ima Short - February 3, 2026

-

Bill Fold - February 2, 2026

Walmart’s New CEO Started As A Shelf Stacker, Here’s How It Can Happen To You

-

Ima Short - January 29, 2026

Trade Deficit Hits Biggest Widening In 34 Years Despite AI Boom, Here’s What Happens Next

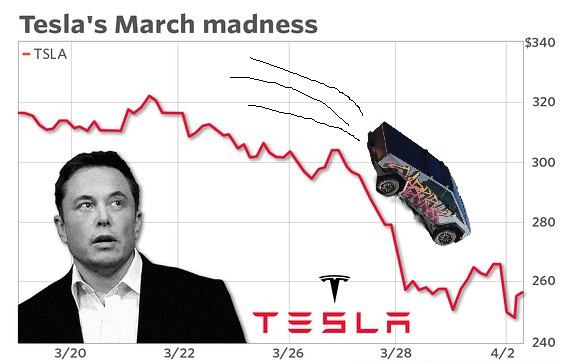

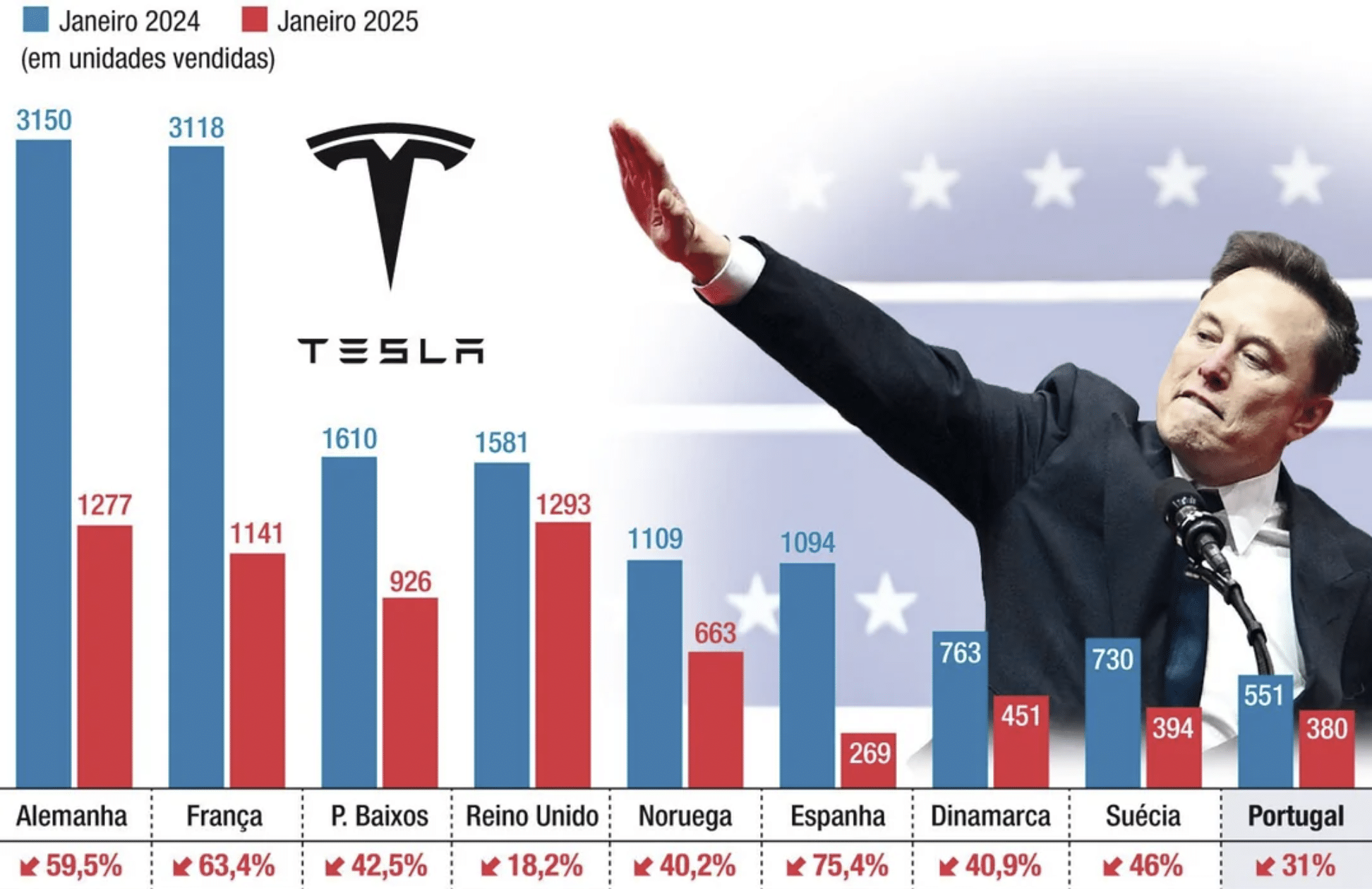

The richest man in the world just got significantly more richerer because Tesla hit a new high and SpaceX’s latest tender offer just valued the company at $800 billion dollars in actual money rocketing Musky-Man’s net worth to $684.3 billion dollars in actual monetaries.

It all makes you wonder, what does a man like Musk possibly buy himself for Christmas? Well, I just happen to have his letter to Santa right here on my desk and it looks like he’s in the market for an entire country.

So without further ado, in no particular order, here are five countries that have a GDP lower than Elon Musk’s net worth (that means you can buy it then, right?):

5. Belgium – $665b

This is the most expensive country on Elon’s list even though it’s pretty small and there’s not really much there. What do they have, like, chocolate? I guess that’s cool, he could retire and become like Willy Wonka.

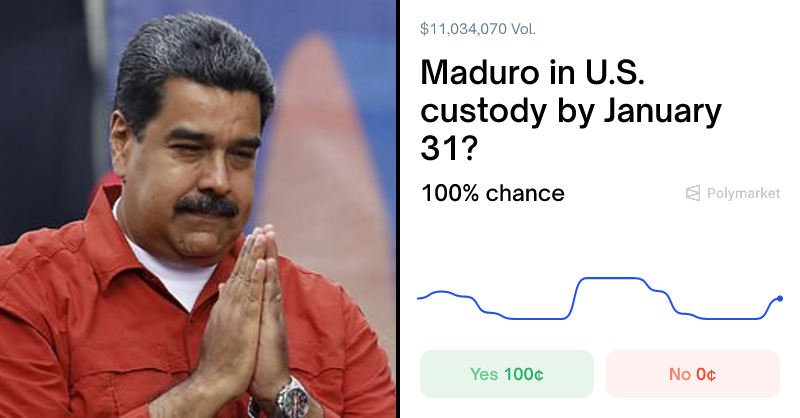

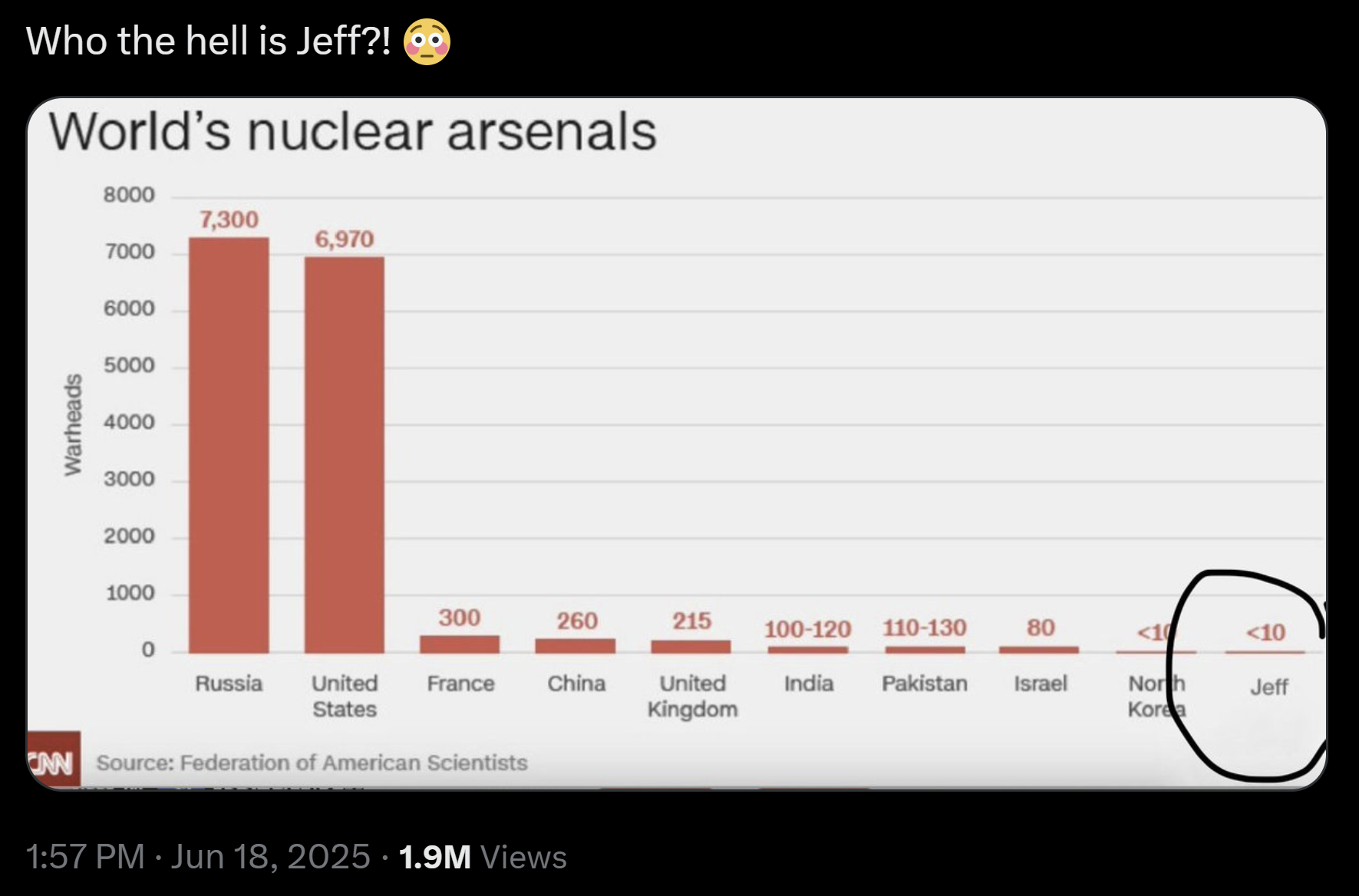

4. Israel – $540b

There’s only one way to solve the problems in the middle east and that’s to BUY ISRAEL. With this new purchase, Musk could achieve world peace or he could use his robots and spaceships for war. It’s entirely up to him. …Man, Musk really is on the brink of becoming Lex Luthor, isn’t he?

3. Kazakhstan – $288b

The largest item in Elon’s shopping basket here, Kazakhstan is over a million square miles of beautiful verdant scenery. With this new land he could probably build a Grok-powered city, or maybe a hyperloop that actually goes somewhere. Or maybe the meme king will just build a giant statue of Borat.

2. The United Arab Emirates – $537b

Now this one surprised me, I didn’t expect the home of billionaire’s playground, Dubai to have a lower GDP than some other countries on this list but here we are. Hey, if you’re for sale UAE, then Elon’s buying. I’m just saying.

1. Literally any country that’s not the US, China, Germany, Japan, India, UK, France, Italy, Canada, Brazil, Russia, Mexico, Australia, Spain, South Korea, Indonesia, Turkey, Saudi Arabia, Netherlands, Switzerland or Poland

Name a country, any country in the world and so long as it’s not on the above list it’s GPD is lower than Elon’s current net worth.

Crazy.

Latest news

-

Ima Short - February 3, 2026

Someone Just Built Reddit But Exclusively For Chatbots, Is The AI Bubble Just Eating Itself?

-

Bill Fold - February 2, 2026

Walmart’s New CEO Started As A Shelf Stacker, Here’s How It Can Happen To You

-

Ima Short - January 29, 2026

Trade Deficit Hits Biggest Widening In 34 Years Despite AI Boom, Here’s What Happens Next