Bezos Sells Amazon Shares To Pay For Wedding, Narrowly Avoids Bankruptcy

Latest news

-

Bill Fold - July 3, 2025

-

Max Profit - July 2, 2025

Bezos Sells Amazon Shares To Pay For Wedding, Narrowly Avoids Bankruptcy

-

Marge Incall - July 1, 2025

Crying America Begs Mommy And Daddy To Stop Fighting

-

John Combs - June 30, 2025

Canada Scraps US Digital Tax, Apologises 26,000 Times

-

Ima Short - June 26, 2025

Crypto Becomes Asset For Mortgages, Fartcoin Now Worth ‘Abandoned Warehouse With No Doors’

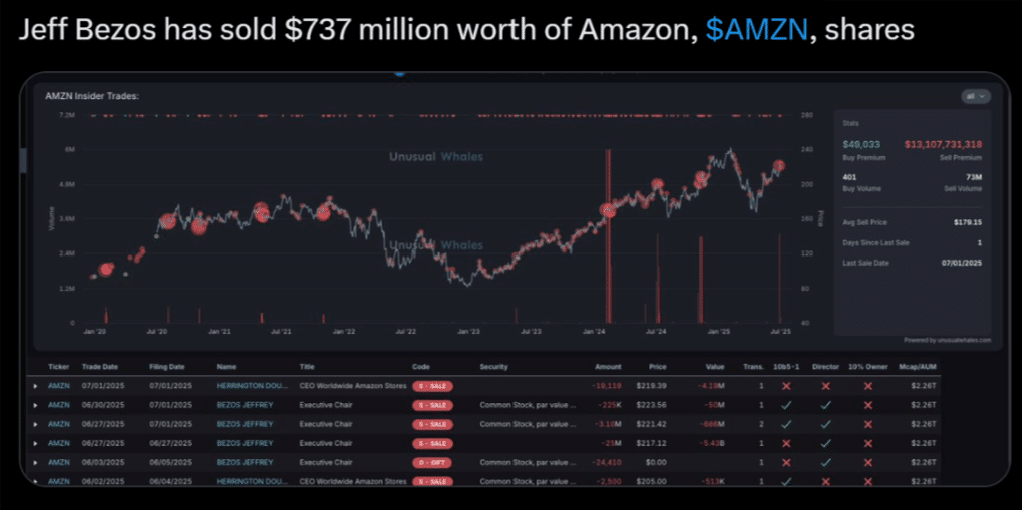

Amazon CEO Jeff Bezos has sold off $737 million worth of Amazon ($AMZN) shares in order to fund his lavish wedding in Venice this week.

Even though he ticked next-day delivery at checkout, Bezos’ wedding took five days to complete, spanning multiple historic sites in Venice. Reportedly, the bride, Lauren Sánchez (no relation) had 27 dresses in reference to the film, 27 Days Later.

90 private jets brought in 250 guests, including a who’s who of principled millionaires who once proselytized for all the things that Amazon stands against. Bill Gates, Leonardo DiCaprio, Andrew Garfield, Oprah Winfrey, Barbra Streisand, Lady Gaga, the dog from the new Superman movie, and the three ghosts of expensive weddings past.

Apparently, my invite was lost in the mail.

One surprise guest, Katy Perry, somehow made it past security after Bezos but failed to disrupt the wedding itself. Perry and Bezos are currently involved in a bitter feud after Bezos’ failed attempt at murdering the singer by launching her into space.

With an engagement ring worth $3-5 million and two engagement parties, groomzilla Jeff was already over budget and desperate for more capital to fund his wedding.

Fearing a choice between bankruptcy or upsetting his future second ex-wife to be, Bezos suddenly remembered that he was in possession of some of the most valuable stock options in the world and instantly dumped a Boeing’s worth of collateral just to keep the gondola afloat.

Plans were also scaled back from a wedding occurring entirely in outer space to a boring, lame Earth wedding. Ew.

Bezos is reportedly already planning a lavish divorce at the Taj Mahal.

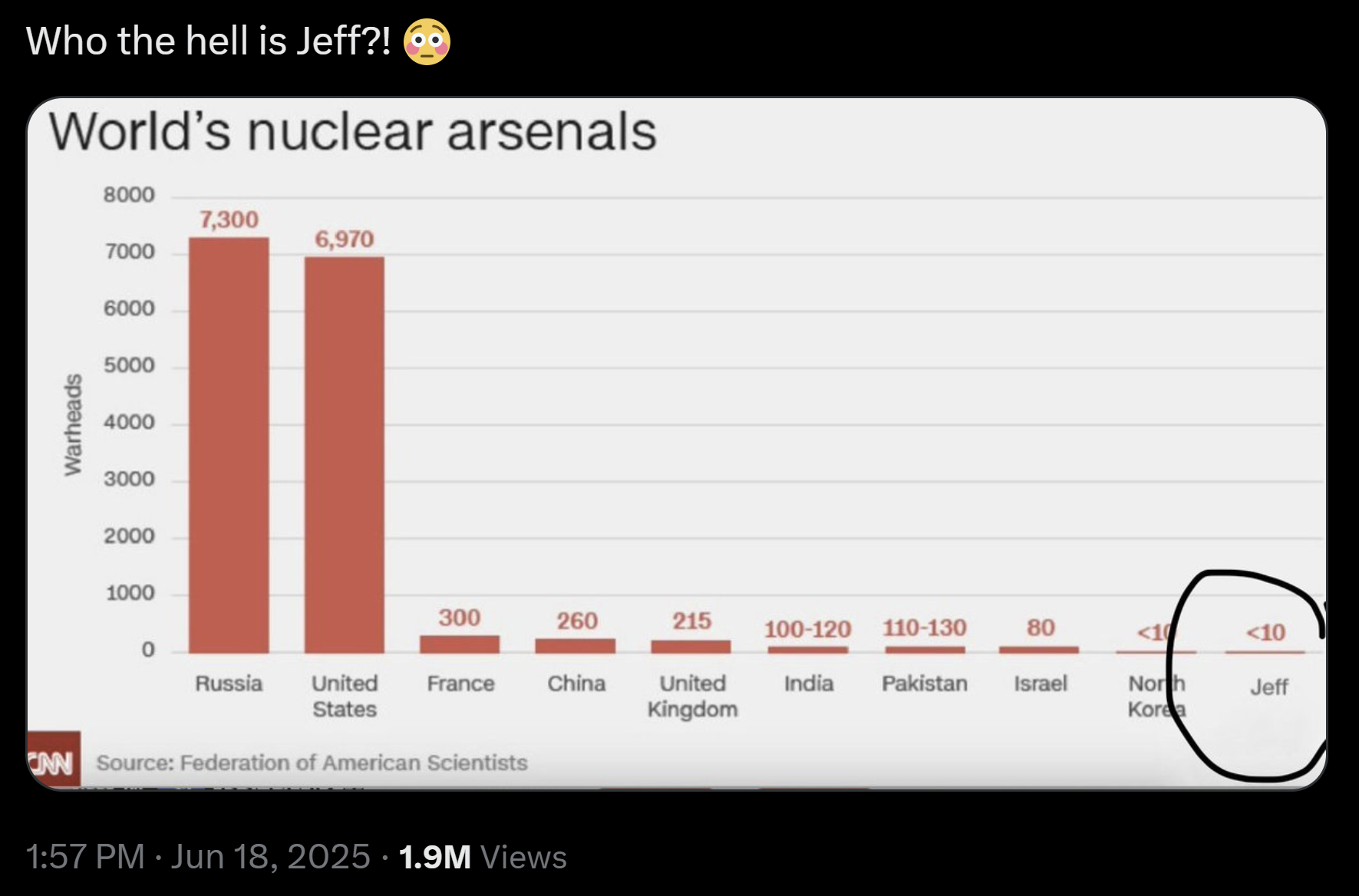

For more news about everything Bezos, click here: Trump Declares War On JEFF, “That Man Cannot Have Nukes”

Latest news

-

Bill Fold - July 3, 2025

Trump Reveals Plan To Tax Gambling Losses, Degens Now 10% More Unlucky

-

Max Profit - July 2, 2025

Bezos Sells Amazon Shares To Pay For Wedding, Narrowly Avoids Bankruptcy

-

Marge Incall - July 1, 2025

Crying America Begs Mommy And Daddy To Stop Fighting

-

John Combs - June 30, 2025

Canada Scraps US Digital Tax, Apologises 26,000 Times

-

Ima Short - June 26, 2025

Crypto Becomes Asset For Mortgages, Fartcoin Now Worth ‘Abandoned Warehouse With No Doors’