Crypto Becomes Asset For Mortgages, Fartcoin Now Worth ‘Abandoned Warehouse With No Doors’

Latest news

-

Max Profit - July 8, 2025

-

Pen Smith - July 7, 2025

Elon Starts America Party, Trump Forms South Africa Party In Retaliation

-

Bill Fold - July 3, 2025

Trump Reveals Plan To Tax Gambling Losses, Degens Now 10% More Unlucky

-

Max Profit - July 2, 2025

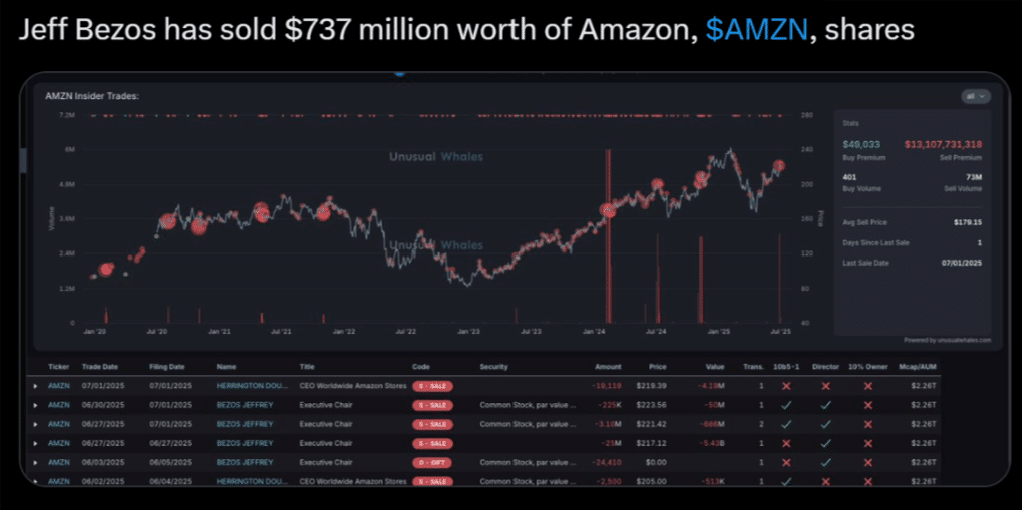

Bezos Sells Amazon Shares To Pay For Wedding, Narrowly Avoids Bankruptcy

-

Marge Incall - July 1, 2025

Crying America Begs Mommy And Daddy To Stop Fighting

-

John Combs - June 30, 2025

Canada Scraps US Digital Tax, Apologises 26,000 Times

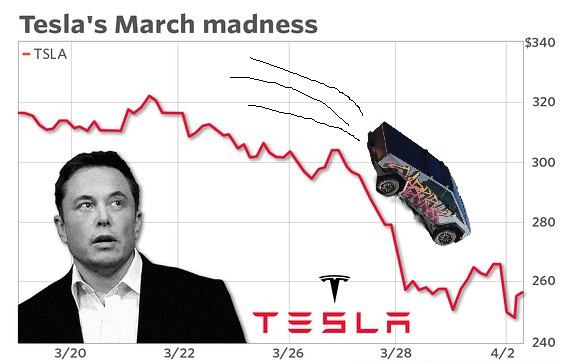

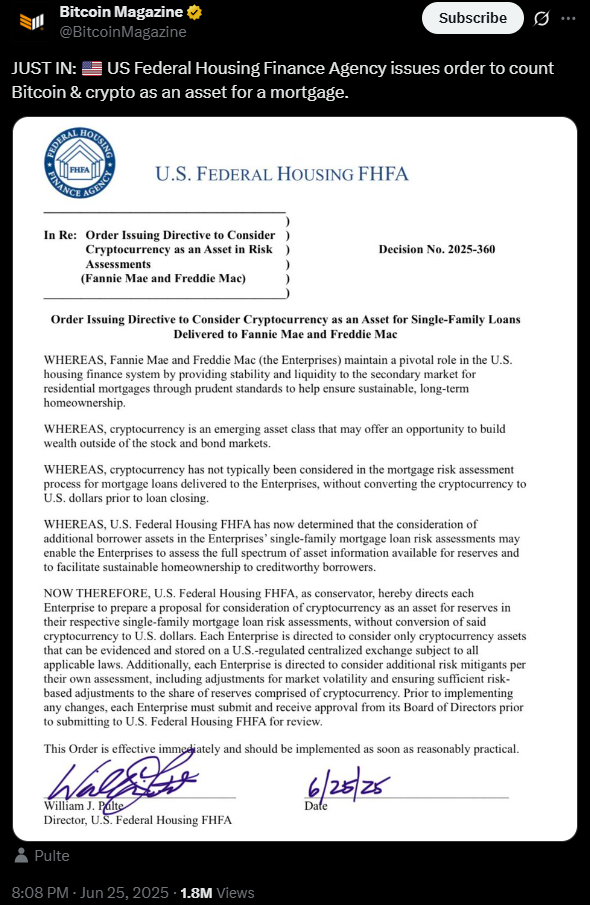

In news that would give any boomer an aneurysm, the US Federal Housing Finance Agency has just issued an order to value Bitcoin and crypto as assets for a mortgage.

Real estate just got a little more virtual, paving the way for zip code NFTs and shitty timeshares scams entirely on the blockchain.

After decades of being denied access to the property ladder, coiners can now join the exclusive club of people allowed to own houses, along with anyone over the age of 50 and shady Russian oligarchs.

Bitcoin owners across the world collectively high-fived each other and said, simultaneously, “What could possibly go wrong?”

In completely unrelated news, Paramount Pictures has greenlit ‘The Big Short 2: Electric Boogaloo’.

Whilst details about the script remain under lock and key, producers have hinted that they were “Inspired by very recent events.”

“I’m not saying we’re heading for another housing market crash,” commented Adam McKay, who’s already signed on to direct the sequel. “But we’re heading for another housing market crash.”

“This one’s going to be spicier than the original, though,” McKay continued. “We’ve already cast Zach Galifianakis as Elon Musk and George Clooney as a Bitcoin.”

Alright, if that’s all the news for today, I’m off to go swap my DOGECOIN for a mansion with a view of the ocean.

For more coin news, click here: GameStop YOLOs $513M into Bitcoin

Latest news

-

Max Profit - July 8, 2025

Jack Dorsey Unveils ‘Bitchat’, Musk Already In Talks To Buy And Rename It ‘XChat’

-

Pen Smith - July 7, 2025

Elon Starts America Party, Trump Forms South Africa Party In Retaliation

-

Bill Fold - July 3, 2025

Trump Reveals Plan To Tax Gambling Losses, Degens Now 10% More Unlucky

-

Max Profit - July 2, 2025

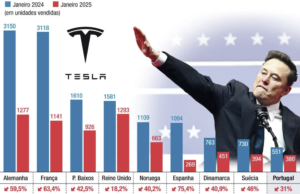

Bezos Sells Amazon Shares To Pay For Wedding, Narrowly Avoids Bankruptcy

-

Marge Incall - July 1, 2025

Crying America Begs Mommy And Daddy To Stop Fighting

-

John Combs - June 30, 2025

Canada Scraps US Digital Tax, Apologises 26,000 Times