Buffett Just Unloaded $4.4b In Tech Stocks And The Big Seven Are Bricking It

Latest news

-

Pen Smith - March 5, 2026

-

Bill Fold - March 4, 2026

Barron Trump Bought $30m In Oil 2 Days Before War, Did He Know Something We Didn’t?

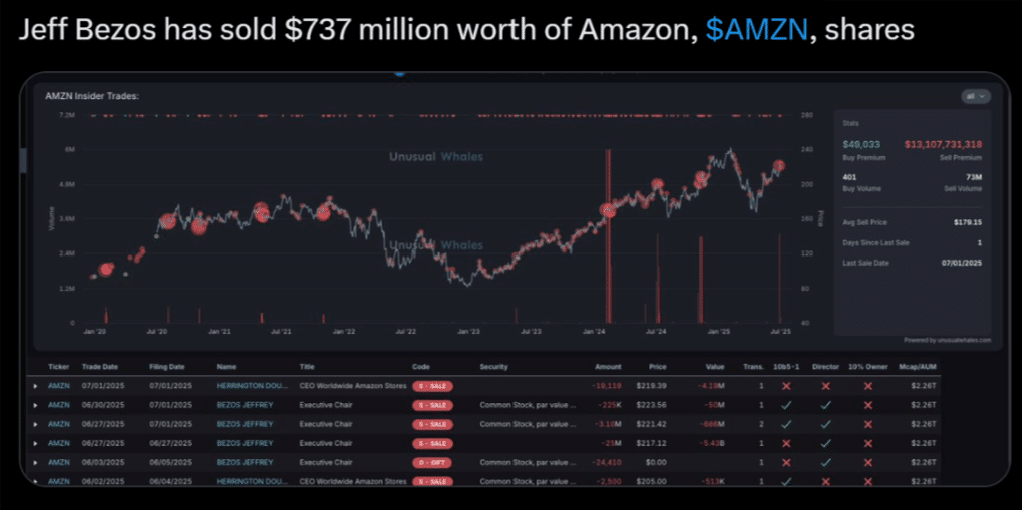

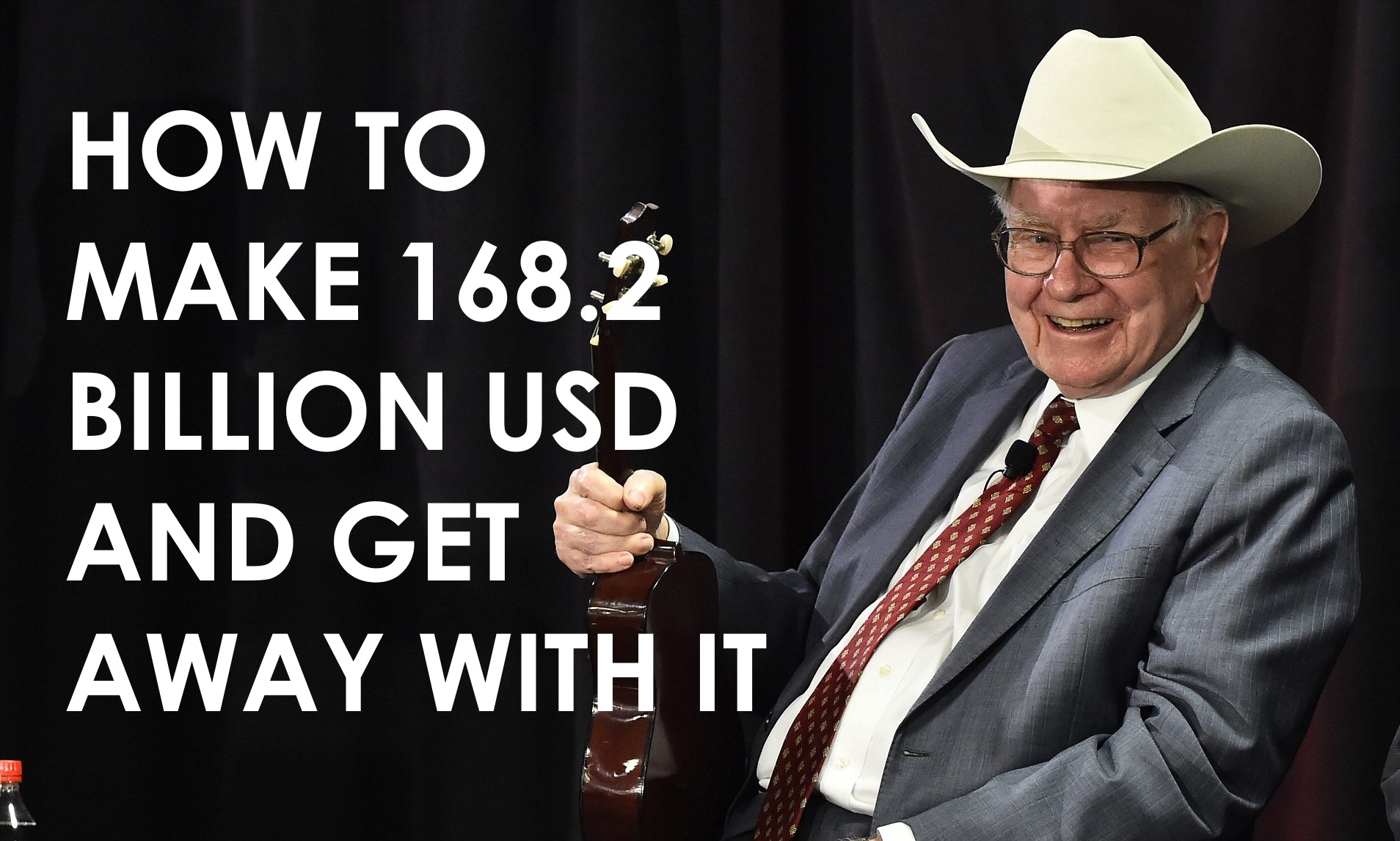

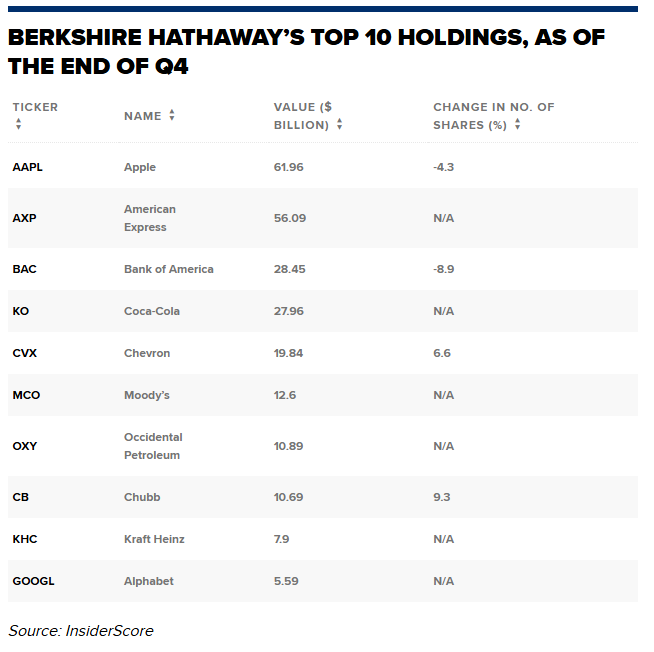

Famous investor/old man Warren Buffett just ordered his investment firm Berkshire Hathaway to drop 77% of its Amazon stake (a total of $1.7 billion) in one of his final moves before retiring. What’s that phrase, ‘you’re most remembered words are your last ones’…?

Combine this mega dump with Buffett dropping $2.7 billion from Apple last quarter and we’ve got a $4.4 billion dollar bet against big tech. Should silicon valley be worried now or…?

Maybe not. Apple is still Berkshire Hathaway’s biggest holding, with a massive $61.96 billion vote of confidence in the iPhone manufacturer. Plus Buffett just grabbed a massive stake in the Google company, Alphabet. So, despite the headline, BH is very much still all in on tech.

There’s a chance as well that this isn’t even Buffett’s work, potentially being decisions by investment managers Todd Combs, Ted Weschler or CEO Greg Abel as a way to ease into Warren’s departure.

NOTE TO SELF: WARREN BUFFETT IS IN NO WAY RELATED TO NOTABLE ACTOR WARREN BEATTY DESPITE HAVING SIMILAR NAMES.

The new CEO was hand picked by Beatty, but the question remains, is he really Abel?

All you can eat Buffett

The big WB casts a long shadow, with over twenty decades of experience in Wall Street, he’s long been a guiding light for many investors. But now, with the sale of WB to Netflix, who’s to know what the future holds. Will Buffett still be allowed in cinemas or will he become streaming only for the rest of his life?

Also, I’m worried about him because my granddad loved his work as a dog lobotomist but when he had to retire at the age of 63 (he had the shakes by that point and the dogs were coming out like swiss cheese) his whole purpose had gone and it just seem like he lost the will to live. He died not two years later. I mean, yeah, he was hit by a truck, but that’s by the by.

Point is, Buffett is 95. He was born in 1930, that’s crazy. He’s about to retire after working for thirty decades on Wall Street. How does a guy like that just retire? I’m scared for him is all that maybe he’ll go the way of my gramps. STAY OFF THE STREETS, WARREN!!

Latest news

-

Pen Smith - March 5, 2026

Big Tech Signs Trump’s Pledge To Limit AI Energy Costs, But Will It Work?

-

Bill Fold - March 4, 2026

Barron Trump Bought $30m In Oil 2 Days Before War, Did He Know Something We Didn’t?