Bitcoin Reaches ATH, Pizza Now Worth $1bn

Latest news

-

Ima Short - February 3, 2026

-

Bill Fold - February 2, 2026

Walmart’s New CEO Started As A Shelf Stacker, Here’s How It Can Happen To You

-

Ima Short - January 29, 2026

Trade Deficit Hits Biggest Widening In 34 Years Despite AI Boom, Here’s What Happens Next

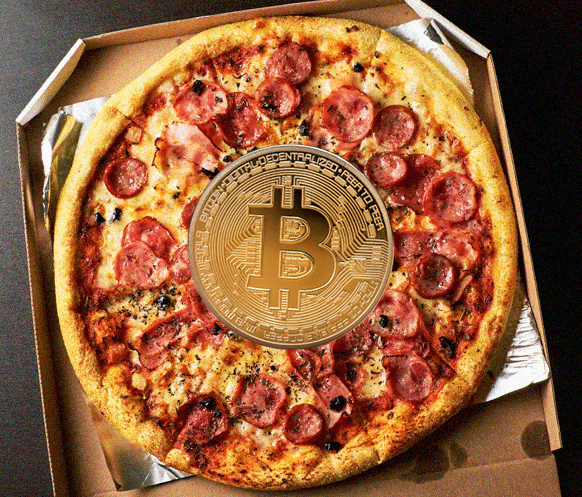

Happy Bitcoin Pizza Day, everybody! No, wait… Happy BTC ATH, everybody! It’s that time of year again, yes, rising from the blockchain every May like a crusty phoenix from a wood-fired oven, it’s the traditional recalculating of the cost of the most expensive pizza in human history!

But it’s extra fitting since Bitcoin just hit a new all-time high, so it’s time to ask the real questions: what is 10,000 BTC worth today? And more importantly, how many toppings did Laszlo actually get?

For any gen Z degens who think Satoshi was a TikToker, here’s a quick history lesson:

On May 22, 2010, Laszlo Hanyecz made history by trading 10,000 BTC for two Papa John’s pizzas. Yes, really. It was the first real-world transaction using Bitcoin, and yes, they were large pies, not personal pans. Laszlo was just a hungry coder with too much BTC and not enough garlic dipping sauce.

At the time, 10,000 BTC was worth about $41. Today? Let’s do some totally unnecessary, deeply painful math.

Let’s Crunch the Bitcoin Numbers (and Laszlo’s Soul)

Current BTC Price: $108,996.20 (give or take when I checked this)

Total BTC Spent on Pizza: 10,000

Total Value of Pizza Today: 1 billion freaking dollars

Value Per Slice (assuming 16 slices): ~$62.5 million

Value of the Garlic Sauce (adjusted for inflation and emotional damage): Priceless

Laszlo didn’t just buy pizza. He bought a cultural meme that resurfaces every year like a blockchain Groundhog Day, where crypto bros gather to remind themselves that patience is a virtue, and food is temporary, but trauma is forever.

What Could $1bn Buy in 2025?

- An actual island (and the Web3 DAO to govern it)

- Every single Bored Ape, plus therapy for their owners

- 5000 Lambos (and enough gas for, like, a week)

- Twitter. Again.

- Or… 2 more pizzas at current NYC prices

Was It Worth It?

Yes. Because without that pizza, Bitcoin may never have taken its first steps into the real world. Without Laszlo’s sacrifice, we might still be trading satoshis for Magic: The Gathering cards and hoping CNBC takes us seriously.

So let’s raise a slice this May 22. Not just for the pizza. But for every single crypto bro who’s ever looked at an old wallet and whispered: “If I’d just held…”

To read more about this story, click here: Bitcoin To Change Ticker To ATH After Massive Gains

Latest news

-

Ima Short - February 3, 2026

Someone Just Built Reddit But Exclusively For Chatbots, Is The AI Bubble Just Eating Itself?

-

Bill Fold - February 2, 2026

Walmart’s New CEO Started As A Shelf Stacker, Here’s How It Can Happen To You

-

Ima Short - January 29, 2026

Trade Deficit Hits Biggest Widening In 34 Years Despite AI Boom, Here’s What Happens Next