Bulgaria’s Bitcoin Could Have Erased Its National Debt But They Sold It In 2017, Here’s 5 More Legendary Fumbles

Latest news

-

Pen Smith - March 5, 2026

-

Bill Fold - March 4, 2026

Barron Trump Bought $30m In Oil 2 Days Before War, Did He Know Something We Didn’t?

In 2017 Bulgaria had a massive stockpile of 213,500 Bitcoin but sold it all. Today that much would be worth $14,393,970,038.96 dollars. That’s not enough to wipe out its $37.1 billion national debt, despite what the headline says, but still…

Look, I just got this from a tweet and I started writing before I actually looked any of this up but what do you expect? Journalist integrity? I mean, you’re getting your information from Wall Street Memes Dot Com so who’s the real criminal here?

Anyways…

Bulgaria’s Bitcoin blumber (lol, I meant to say ‘blunder’) will go down as one of history’s biggest fumbles, but it’s not the first time people have lost out on a bit’o’coin. Read on to learn more:

Germany’s Billion Dollar Blunder

In 2024, Germany seized around 50,000 Bitcoin worth about $2.2 billion and immediately dumped it into the market. Bitcoin obviously later surged and if they’d just held on a bit(coin) longer, they could have made gains of $3.6 billion. Damn girl. Sucks to be German right now.

Bitcoin Pizza

I’m sure you’ve heard about it, the very first Bitcoin transaction in history. On May 22, 2010, Laszlo Hanyecz made history by trading 10,000 BTC for two Papa John’s pizzas. Well, now that pizza would be worth $672,494,956.28 and Laszlo can still be heard crying into his garlic dip to this day.

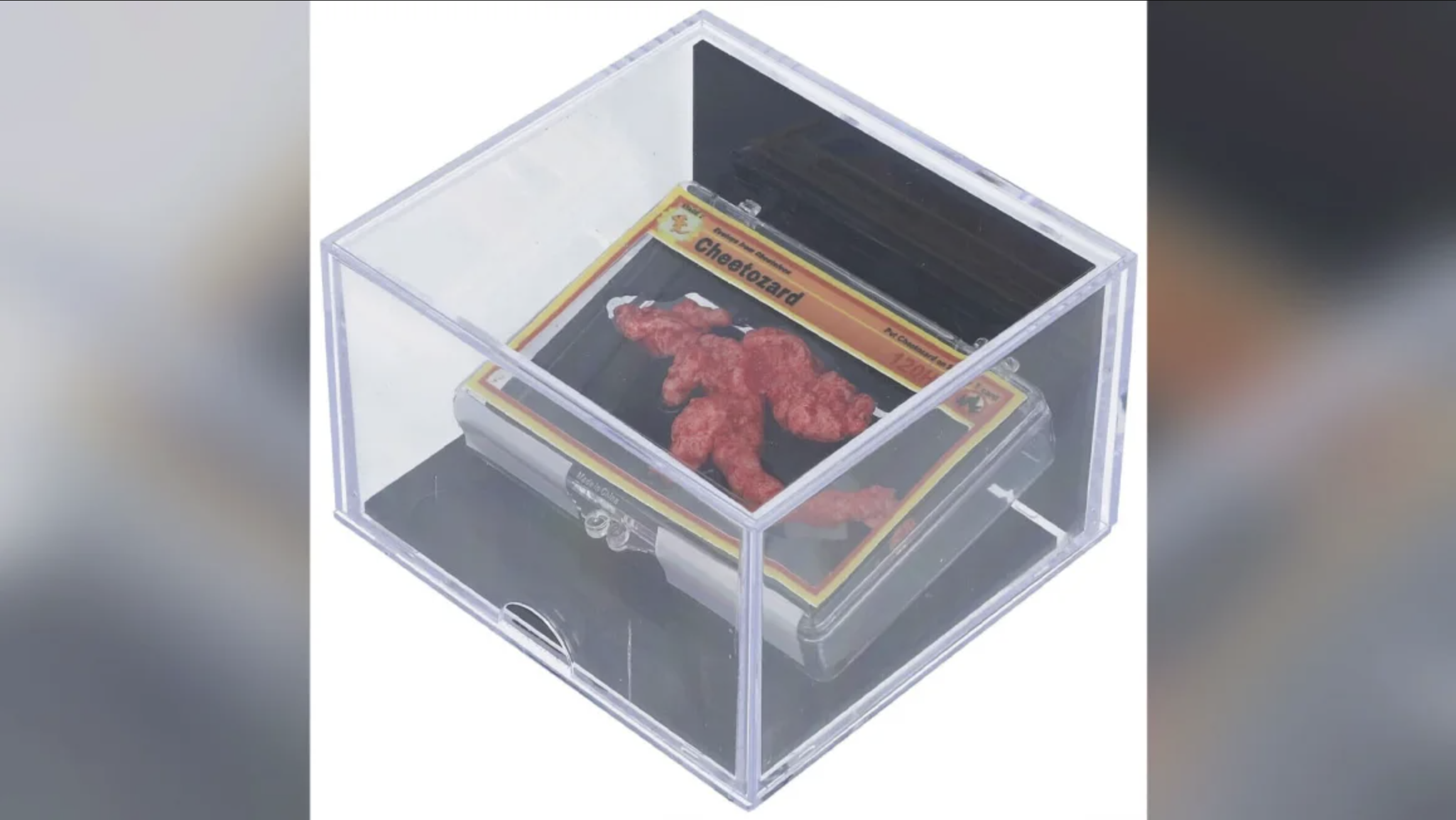

Bored Ape Mispricing

Before Bored Apes were boring, NFT trader Maxnaut listing Bored Ape Yacht Club #3547 for 0.75 ETH (~$3,000) instead of 75 ETH (~$300,000). A bot purchased the listing instantly and relisted it for full market value, netting an enormous profit. Yikes.

Crypto.com’s Unrefundable Refund

In 2021, Crypto.com refunded a $100 to an Australian user but accidentally transferred A$10.5 million (~$7 million USD) due to a field entry mistake. Thevamanogari Manivel, used the funds to buy property and distribute gifts before the exchange discovered the error months later during an audit. The site recovered most of the money in a lawsuit but still lost out big.

Tether Mints $5 Billion USDT By Accident

In July 2019, Tether, the issuer of the world’s largest stablecoin, USDT, accidentally minted $5 billion worth of tokens on the Tron blockchain while performing a routine chain swap. The mistake happened during a migration process between Omni and Tron networks, when the operator misentered a decimal value. Those pesky periods. Women and Bitcoin miners worst enemy.

Shout out to this article that I cribbed those last three entries from because cba today. You think these were massive fumbles? Babes, I’m fumbling my whole life.

Latest news

-

Pen Smith - March 5, 2026

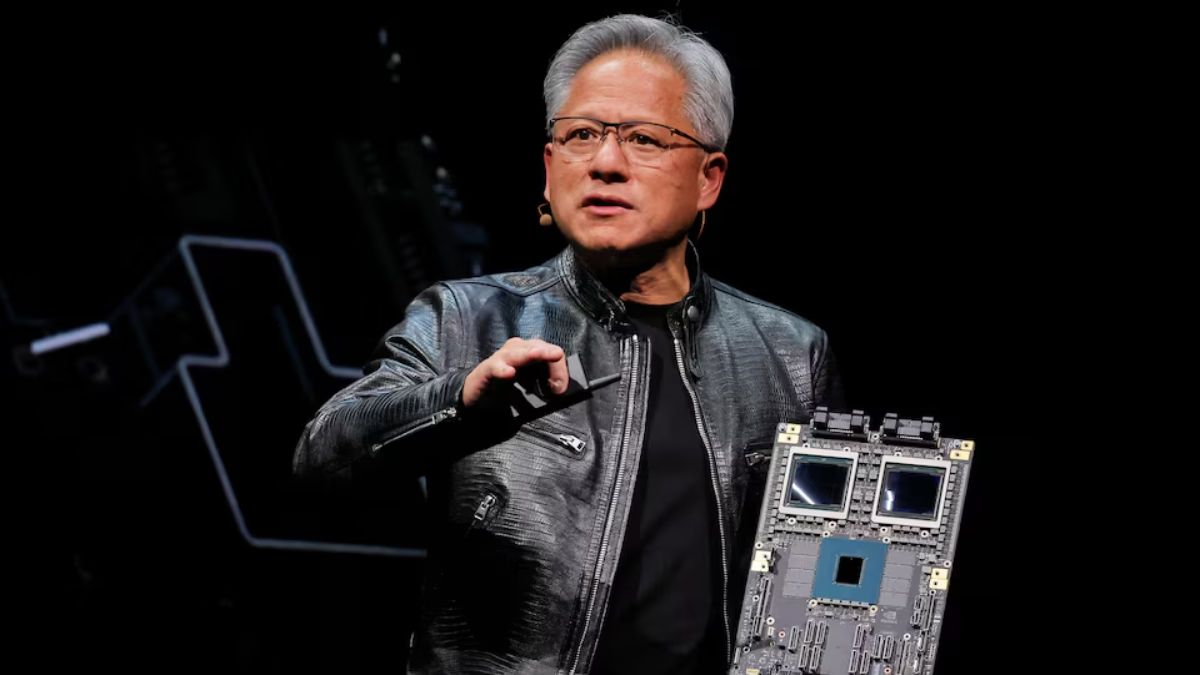

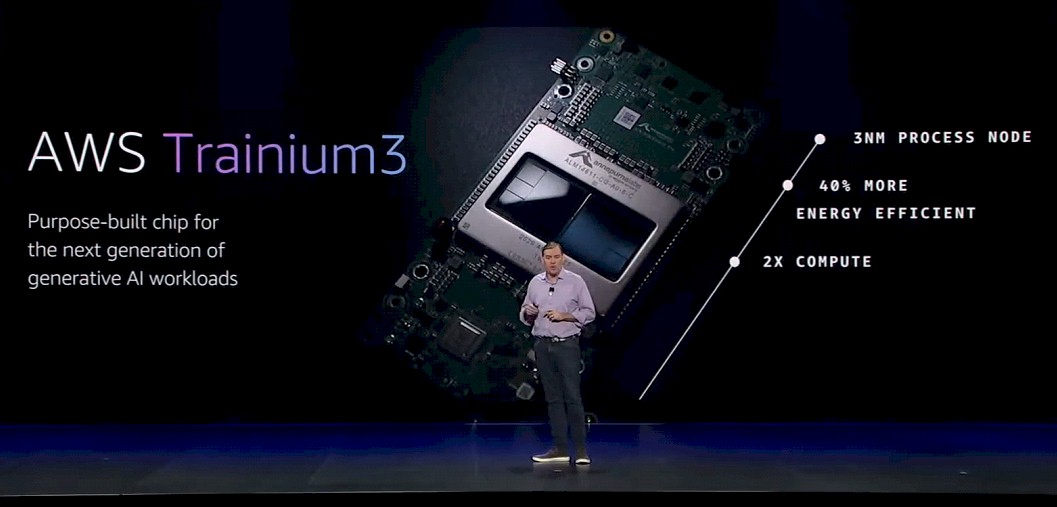

Big Tech Signs Trump’s Pledge To Limit AI Energy Costs, But Will It Work?

-

Bill Fold - March 4, 2026

Barron Trump Bought $30m In Oil 2 Days Before War, Did He Know Something We Didn’t?